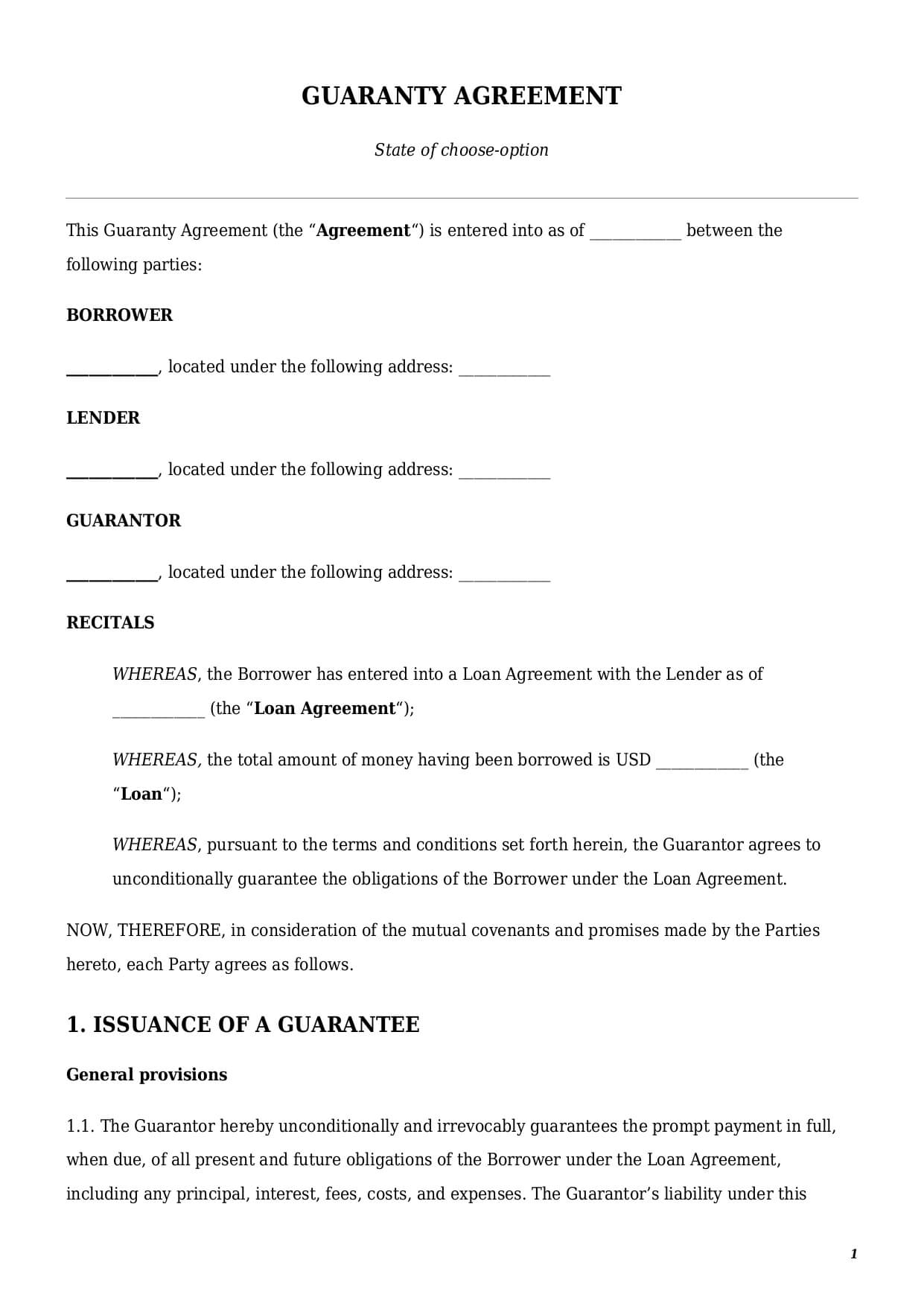

Guaranty Agreement

Reviews

What is a guarantee agreement?

A guarantee agreement, also known as a guarantor agreement, is a legally binding document under which a guarantor assumes a financial and legal responsibility for the debt or obligation of another party.

A guarantor agreement is a powerful legal shield that guarantees to a creditor return of their money when the time comes.

This template can be used to secure a creditor’s obligations under personal or business loan agreements or promissory notes.

The parties involved in a guarantee obligation are:

- creditor or lender (i.e., a person who lends money);

- borrower or debtor (i.e., a person who borrows money from a lender); and

- guarantor (i.e., a person who guarantees return of the loan by a debtor).

Signing a guaranty agreement is a formal process that requires the guarantor’s signature to validate the contract. Unlike for the loan contracts, a personal guarantee agreement is a one-sided agreement under which a guarantor assumes certain obligations. Therefore, only a guarantor shall sign this document.

If a guarantor is a legal entity, in that case a guarantor agreement shall be signed by a company’s representative, like a director, secretary, or attorney.

How to draft a simple guarantee agreement?

Drafting a simple guarantee agreement is a challenging task, as it involves careful consideration of several critical elements to ensure that the rights and responsibilities of all parties are clearly defined.

Details of the Original Loan Agreement

Any guaranty agreement for loan should contain details of the original loan contract it refers to. Those details should include:

- type of the loan (e.g., loan contract or promissory note, date of issuance);

- the original amount of the loan and its currency;

- detailed description of a collateral (if any); and

- parties involved (i.e., full legal names and addresses of a borrower and lender).

The guarantor agreement template should explicitly reference the original loan or credit agreement it supports. This includes specifying the date of the loan agreement, the principal amount loaned, the interest rate, repayment terms, and any collateral involved. Accurate incorporation of these details ensures that the guarantee is tied directly to the specific financial obligation, avoiding ambiguity.

Type of Issued Guarantee

The guarantee under a guarantee agreement template could be classified in various ways:

- by amount of liability—limited (i.e., a maximum cap a guarantor shall cover) or unlimited (i.e., the guarantor undertakes to cover all debts and interest, if any);

- by way of application—conditional (i.e., a guarantor shall be liable only if certain conditions are met) and unconditional (i.e., a guarantor is always liable once there is a debtor’s default).

Therefore, it is essential to state directly in a guarantee agreement template which exact type of guarantee is provided. The distinction between the guarantees’ types is crucial and significantly impacts the rights and obligations of the lender, borrower, and guarantor.

Duration of the Guarantee

The guarantee agreement template shall also define the duration of the guarantee. In most of the cases, the guarantee is not limited in time. It means that it remains in force until the loan is repaid in full or the original debt is forgiven.

At the same time, parties to a guarantee agreement template may limit the guarantee’s duration in time. Therefore, it can last from a few months to a few years.

Debtor Default

A well-drafted guarantor agreement sample shall define how the lender shall act once there is a default by the debtor.

A default is a situation in which a debtor cannot repay the loan amount in full or partially. Usually the list of defaults is being listed in the original loan agreement or promissory note. While a guarantee agreement shall only rely on a definition of a default provided in the original contract.

The parties to a guarantor agreement sample may define several ways how the lender shall act in case of a default.

- A lender has to pursue all available remedies against the borrower first. Only if all remedies are exhausted can the lender come after the guarantor.

- A lender has to pursue available remedies either against the borrower or guarantor, depending on the lender’s choice.

- A lender may apply all available remedies only against the guarantor.

How to customize a guarantee agreement at Faster Draft?

In order to personalize your document template, follow a few easy steps below:

- Click the button “Create Document.”

- Answer simple questions in the questionnaire.

- Select a document’s format—guaranty agreement PDF or Word.

- Make a payment.

- Download, e-sign, print, and use your customized document template in seconds.

Table of content

Frequently Asked Questions (FAQ)

-

1. What is the standard guarantor agreement?

Neither federal nor state laws provide any specific requirements a standard guarantor agreement shall have. The final document may always differ depending on the conditions of a loan and the parties’ needs and intentions. At the same time, a guarantor agreement shall have a number of mandatory elements without which it cannot be a legal document. Those elements include:

- details of the parties (guarantor, lender, and borrower);

- details of the original loan agreement (loan amount, date of the loan contract);

- type of issued guarantee (i.e., unlimited or limited in time, full or partial, etc.); and

- default procedure.

-

2. Who can become a guarantor under a personal guarantee agreement?

Legal entities, organizations, and individuals can act as guarantors, provided certain conditions are met.

If the guarantor is an individual, the person shall be of sound mind and above the age of 18. When the guarantor is an organization, the organization shall have a for-profit status. Charity, educational, religious, and scientific organizations that have a non-profit status cannot become guarantors.

If a guarantor is a legal entity such as a partnership, corporation, or other business, in that case the entity’s internal bylaws or statutory documents shall allow it to do so.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates