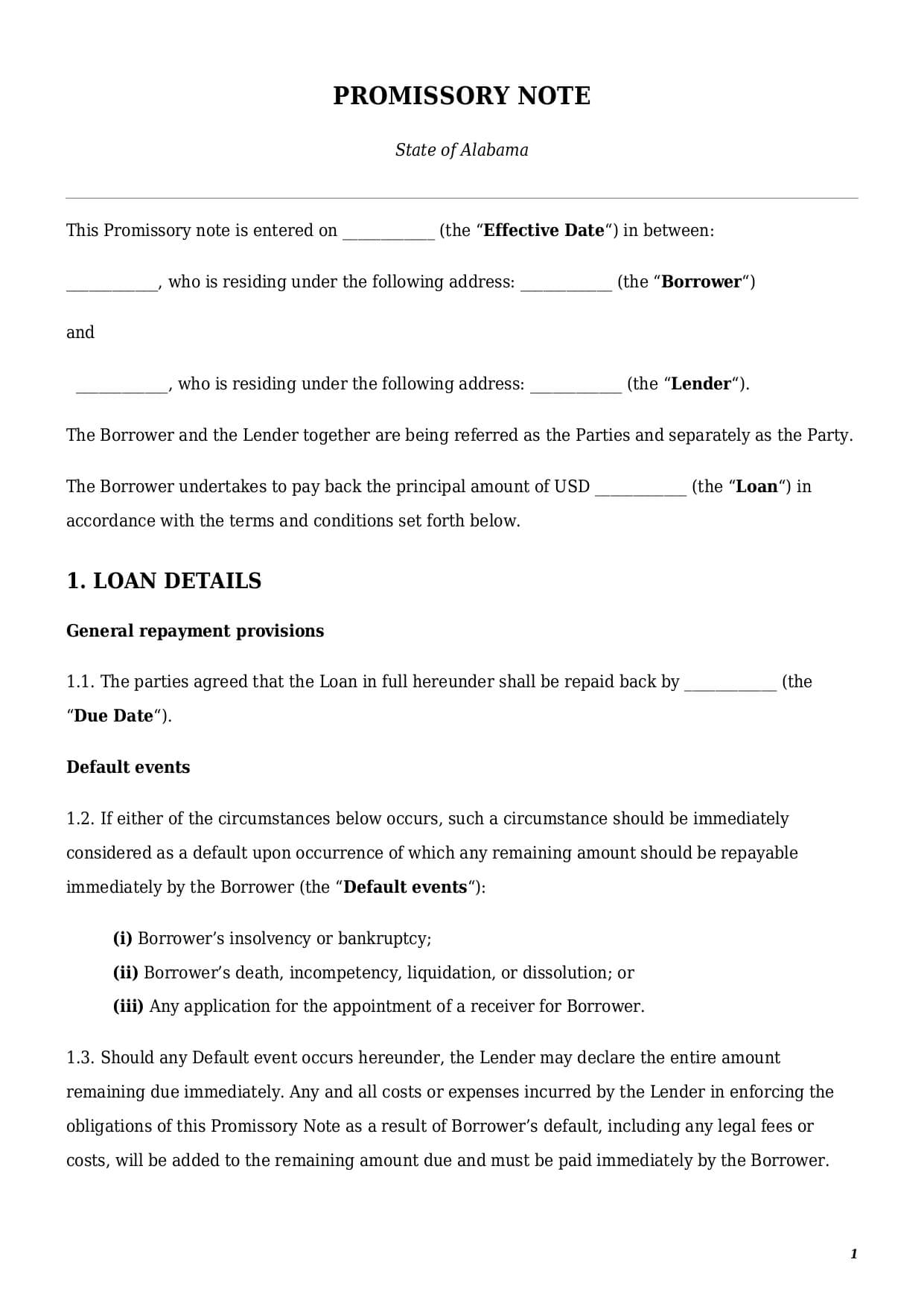

Promissory Note

Reviews

What is a promissory note?

A promissory note, also known as a master promissory note, is a legal document in which the borrower undertakes to repay borrowed money back. The promissory note definition is simple, as this is a standard legal document used by a borrower to confirm the existence of a debt.

A promissory note, also known as a promissory note agreement, is typically used in daily life situations. For example, a friend wishes to lend money to another friend, or money is borrowed between family members.

The parties to this document are a borrower (i.e., a person who borrows money) and a lender (i.e., a person that gives a loan). This document is commonly used between individuals.

A typical promissory note example include the following elements:

- parties details;

- principal amount (i.e., the amount of a debt);

- interest rate (provided a borrower is expected to pay additional interest for using borrowed money);

- repayment date (i.e., a deadline to return the debt);

- date; and

- borrower’s signature.

Loan Agreement vs. Promissory Note

Both documents deal with lending money between two parties. However, if we take a closer look, the mentioned documents are different as follows:

- Format of a legal template

A loan agreement is a complex legally binding contract between a lender and a borrower. The loan is a contract because it establishes rights and obligations for both parties.

You may be wondering, is a promissory note a contract? No, a simple promissory note is not a contract. This is because under a promissory note a borrower undertakes to repay a loan to the lender. At the same time, a lender does not undertake any responsibilities. On top of that, a lender is not required to sign a promissory note itself.

- Structure of a document

A sample promissory note is a simple document that defines due dates, loan amounts, and lender details. The loan contract has a more complex structure and may include the following additional clauses: (1) purpose of the loan; (2) complex interest rates; (3) specific repayment schedule (e.g., in installments); (4) penalties for late payments, etc.

- Applicability of a document

The best way to define a promissory note is to say that this document is for daily situations. While a loan agreement is a document used to lend money between business partners, companies, or organizations.

Types of promissory notes

Depending on the purpose of the transaction, it is possible to outline the following types of promissory notes:

- Secured promissory note

Under this type of promissory note, a borrower’s obligation to repay is backed up by collateral. A collateral is a specific item (e.g., shares, cash, car) that belongs to a borrower and is being used to cover the debt in case of a borrower’s default. In other words, when a borrower cannot pay back a lump sum or interest, a lender can take collateral instead.

- Unsecured promissory note

This is a promissory note sample where a borrower’s obligation is not secured by collateral.

- On-demand promissory note

A good example of promissory note on demand is when there are no due dates. This is when a borrower has to repay back a loan immediately after the receipt of a lender’s demand.

- Convertible promissory note

Convertible promissory note templates are used in start-up financing. Instead of repaying back a loan amount and/or interest, a lender can get a certain number of shares in a new company.

How to write a promissory letter?

Neither federal nor state law defines certain requirements of the form for promissory notes. The content may vary depending on parties’ needs and particular circumstances. A good example of a promissory note should contain the following essential elements:

- Borrower’s details

Borrower’s details include full name, address, and contact email address. As a rule of thumb, a borrower cannot assign their obligations under the promissory note to a third party. In order to do that, a borrower has to obtain prior written consent from a lender. A promissory note template automatically gives a lender the right to demand immediate repayment of the loan once a borrower assigns their rights without consent.

- Lender’s details

The lender’s details should include the full name, address, and contact email address as well.

- Loan details

A sample promissory letter should always contain the following essential elements:

(1) loan amount and its currency;

(2) interest rate and period for which interest should be calculated (e.g., per annum, per day);

(3) additional interest rate after due dates (if applicable).

- Default events

Any simple promissory note sample should include the list of the borrower’s default events. A default event is the list of circumstances in which a lender can demand immediate repayment of the loan before the due date. Examples of default events may include a borrower going into bankruptcy or other similar circumstances.

How does a promissory note work?

There are three essential tips to keep in mind to make sure your promissory note has legal enforceability:

- Sign a document

Signing a promissory note by a borrower is essential. Only after its signing does a sample document become a legally binding document. Without signing, you do not have a legal document, and without a legal document, you cannot enforce your rights in the court.

- Check all details

Check all the details carefully to make sure they accurately reflect the parties’ intention. The best way is to have a printable promissory note template at hand to read it carefully before signing.

- Keep a signed copy

A promissory note is a written document that should be executed and signed in two copies—for the lender and borrower. Either party should keep the original for their record.

How can I get a promissory note at Faster Draft?

At Faster Draft you can customize a sample of a promissory note agreement in a few minutes. Follow a few simple steps below:

- Click the button “Create Document”

- Answer questions in the questionnaire

- Select a format for a promissory note template – PDF or Word

- Make a payment

- Your personalized promissory note sample is ready for download.

Table of content

Frequently Asked Questions (FAQ)

-

1. When to Use a Promissory Note?

A sample promissory letter can be helpful in various daily life situations, including:

- getting a student loan from a bank;

- borrowing money from a family member;

- lending money to the best friend;

- financing the start-up of your college friend and many more.

-

2. How Does a Promissory Note Work?

A promissory note is a written legal document. That means that it creates rights and obligations for the parties involved. A promissory note obliges the borrower to repay back the loan amount on time. At the same time, it grants a lender the right to demand repayment of such a loan.

-

3. What does a promissory note look like?

Usually a master promissory note looks like a simple agreement or letter that should be signed by a borrower. It is a 1- or 2-page document that includes all the necessary information.

-

4. How to get a promissory note notarized?

A promissory note is not required to be notarized by all states, excluding Arizona.

To notarize a promissory note, a borrower has to visit a public notary in a town or city a borrower currently resides in.

If a borrower is an individual, he or she should bring the signed copy of a promissory note template and their passport. If a borrower is a company, a company’s representative who signs a promissory note has to bring the following documents:

- their passport or other identity document;

- PoA, the company’s bylaws, or any other document by which a representative is authorized to sign a promissory note on behalf of a company;

- a copy of a signed promissory note.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates