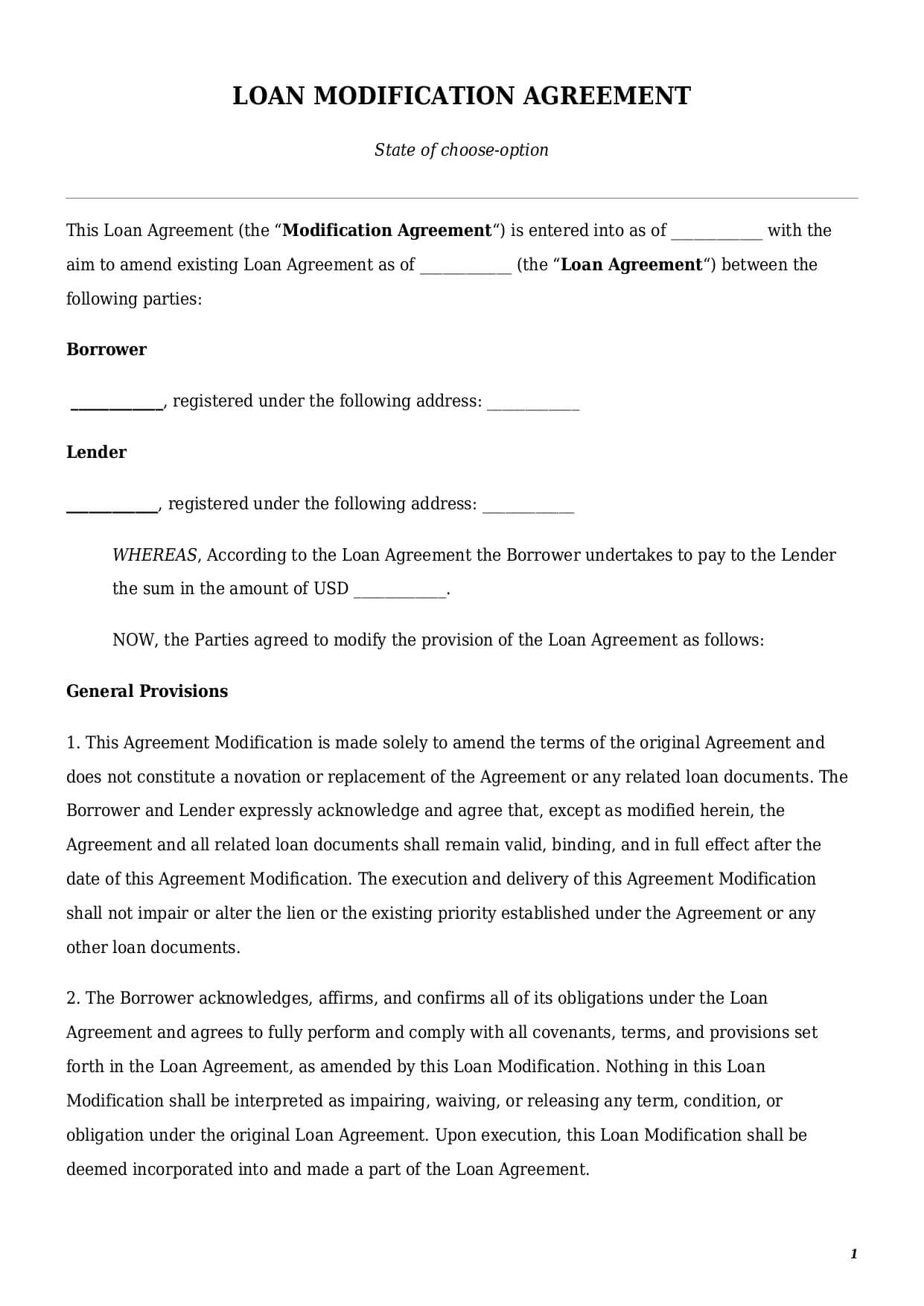

Loan Modification Agreement

Reviews

What is a loan modification agreement?

A loan modification agreement is a formal legal document used to amend the original terms of a loan contract or promissory note. This template allows parties to the original loan contract to change its specific provisions, including:

- payment terms or payment schedule;

- amount of borrowed money;

- purpose for which the loan could be used;

- applicable interest rate and/or late fees; or

- any other provisions.

The parties to a loan modification contract are the borrower and the lender. The borrower is an individual or entity who takes the loan. The lender is a bank, financial institution, entity, or individual who provided the loan. The parties are free to amend the existing loan contract any time.

While drafting a sample loan modification agreement, parties have to keep in mind a number of important legal considerations.

First, any changes to the original loan agreement or promissory note should be agreed upon by both parties. Neither party can amend the existing contract in a unilateral order.

Second, all the amendments should be made in writing. Having a written loan modification agreement ensures that the amended terms are legally binding and enforceable.

Finally, if under the original loan contract there is a guarantor who guarantees a repayment of the loan by a borrower, a guarantor shall also sign a loan modification agreement.

How to draft a loan modification agreement template?

Drafting a loan modification agreement template might be a daunting task. It requires careful attention to detail to ensure the document accurately reflects the agreed modifications. Below we made a breakdown of all important details a solid loan modification agreement template should have.

Details of the parties

The parties to a loan modification contract should be the same parties as to the original loan agreement. We recommend including their full names and addresses.

On top of that, both parties have to put their signatures at the end of the amendment contract. Failure to add signatures results in a document not being valid.

The parties may sign the amendment contract on the same date or on different dates. If a contract is signed on the same date, it becomes effective on that particular date. If, however, a contract is signed on different dates, such a contract becomes effective on the date when the last signature is put.

Acceptable changes

Parties may include any changes in a loan modification agreement sample. It is vital to use clear and precise language to reflect the changes parties wish to insert.

At the same time, there are a number of important legal considerations the parties have to be aware of.

First, an amendment agreement could be easily confused with a novation. Novation is the replacement of the original contract by the new contract. In that situation the original contract ceases to exist, and the new contract replaces it. An amendment agreement implies change or modification of certain provisions only (e.g., interest rate, payment schedule). At the same time, the rest of the clauses remain unchanged.

Second, an amendment agreement should not be confused with an assignment. An assignment agreement is a legal contract under which one party transfers in full their rights and obligations under the original contract to the third party. In this situation the original contract does not change; only the parties to that contract are changed.

Dates

Every solid loan modification agreement template should include:

- the date of an original loan agreement;

- date of a loan amendment agreement; and

- a date on which the changes become effective.

The date on which suggested amendments to the loan agreement become effective could be (1) the date of signing an amendment agreement or (2) any other date in the future. For example, the parties may sign the amendment agreement on the 1st of July. At the same time in the text of that amendment agreement, they may decide that the amendment becomes effective from the 10th of July.

General provisions

Apart from the list of amendments, a good loan modification agreement example should also include a number of important clauses.

First, an amendment contract should state the applicable law. This should be the law of a state that applies towards the provisions of the original contract.

Second, a loan modification agreement should also state that all the rest of the provisions of the original contract remain unchanged.

Finally, we recommend signing a loan modification agreement in several counterparts—one for each party.

How to customize a document’s template at Faster Draft?

In order to get your personalized loan modification agreement sample, follow a few easy steps below:

- Click the button “Create Document.”

- Answer simple questions in the questionnaire.

- Select a document’s format—loan modification agreement PDF or Word.

- Make a payment.

- Download a customized document in seconds.

Table of content

Frequently Asked Questions (FAQ)

-

1. What are the risks of a loan modification?

There are a number of potential financial or legal risks either or both parties may encounter upon signing a loan modification agreement.

Amongst financial risks for a borrower might be an overall increase of costs to pay back the loan. For a lender it may have negative tax consequences if a part or the whole amount of the loan is forgiven.

When it comes to legal risks, it is possible to outline the potential issues below:

- a guarantor fails to accept agreed changes, thus a modification agreement cannot become legally binding;

- a suggested loan modification can affect either party’s credit score in a negative way.

-

2. Is it possible to cancel a loan amendment agreement after its signing?

Yes, the parties may cancel a loan modification agreement. However, the considerations below should be taken into account:

- Such a cancellation should be made by both parties, and

- Cancellation should be in written form.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates