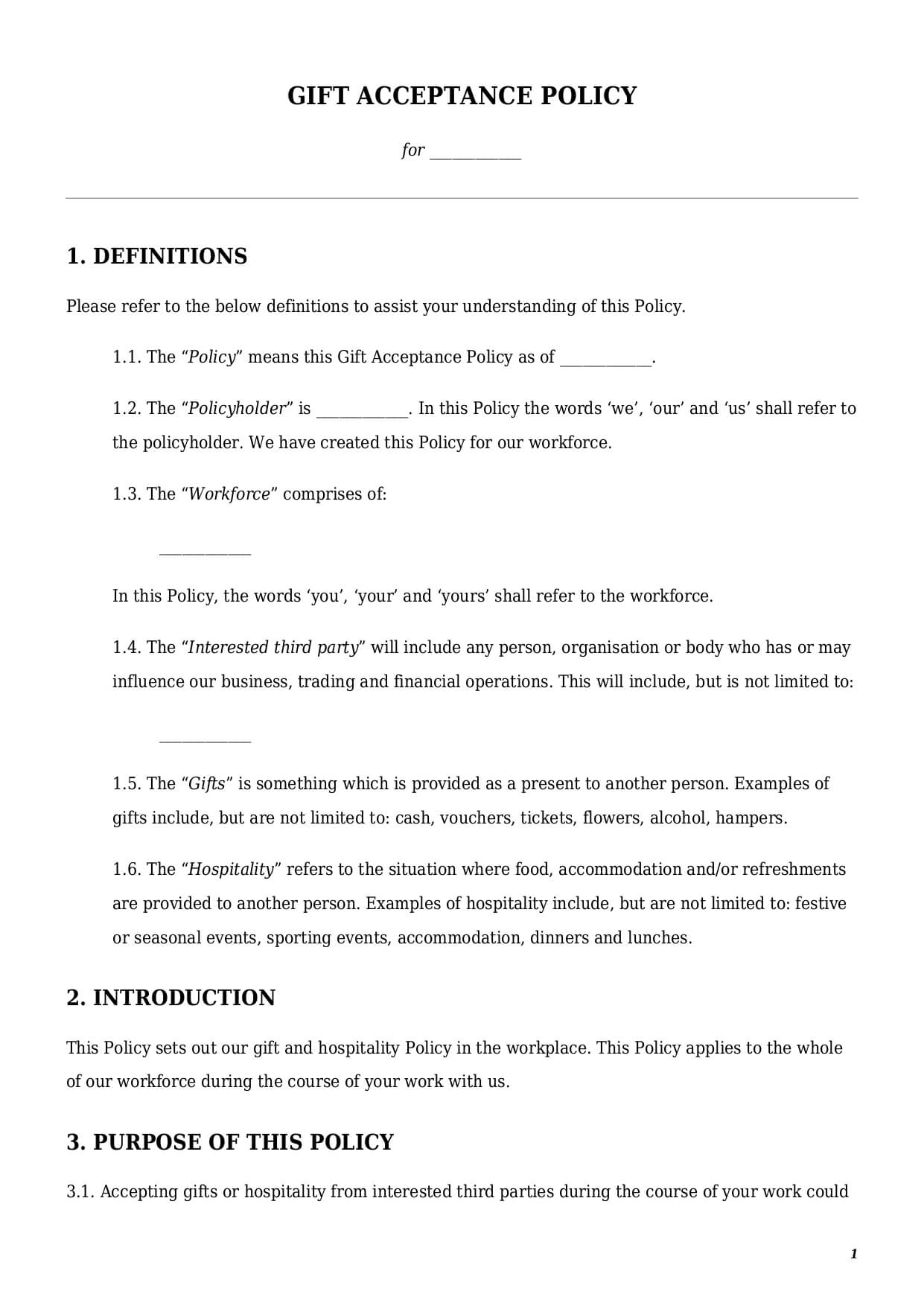

Gift Acceptance Policy

Reviews

What is a gift acceptance policy?

A gift acceptance policy is a formal document that outlines the types of contributions a nonprofit organization can accept, along with the conditions under which those gifts may be received. This policy is an organization’s internal document that provides answers to the following questions:

- To whom this policy shall apply?

- What is a gift?

- What is hospitality?

- What is the maximum acceptable value of a gift?

- What is the policy’s amendment process?

- Who is in charge of supervising the policy?

Neither federal nor state laws require nonprofit organizations across the U.S. to develop and use that policy. However, a nonprofit gift acceptance policy plays a crucial role in an organization’s daily operations and activity. For example, it helps protect the organization from potential legal, ethical, and financial risks while ensuring that donations align with its mission and values.

How to draft a gift acceptance policy template?

When creating a gift acceptance policy template, inclusion of certain essential provisions is a must. Below we made a short checklist of all important things a solid policy template should have:

General Information

The text of every gift acceptance policy shall define the full name of the nonprofit organization, the policy’s purpose, and the definition of used terms.

At the end of a document, a policy’s effective date should be included as well.

There is no requirement to sign this policy to make it legally binding. It is enough to communicate or send such a policy to all of the organization’s members, board, staff, and employees.

Scope of Application

The text of all gift acceptance policies shall identify to whom exactly it shall apply:

- board members;

- members of the organization;

- volunteers working for an organization;

- organization’s officers (e.g., CEO, treasurer);

- organization’s key employees (e.g., head of legal department);

- all employees working for the organization by virtue of employment or service agreements, etc.

Compliance Officer

Having a sample gift acceptance policy is not enough. The organization’s board shall designate a specific person or compliance manager who would be in charge of the policy’s implementation and compliance. A compliance manager could be any person who works for an organization or an outside third party. That person shall remain the first point of contact when it comes to:

- approval of gifts or hospitality;

- reporting of gifts;

- answering questions related to the application of the policy.

Categories of Gifts and Hospitality

A well-drafted gift acceptance policy for nonprofits usually defines:

- Acceptable gifts and hospitality: Items or benefits that are acceptable at any time.

- Approved gifts and hospitality: Items or benefits that could be accepted only upon prior approval from a compliance manager.

- Restricted gifts or hospitality: items or benefits that cannot be accepted (e.g., goods or services whose value exceeds a certain threshold).

Careful thought should be given to so-called gifts or hospitality coming from ‘interested third parties.’ Interested parties are individuals, businesses, or organizations that have a major financial or decision-making influence over nonprofit organizations. Examples of interested third parties may include major organizations’ donors, sponsors, or stakeholders. Usually acceptance of gifts from interested third parties is prohibited.

Approval Procedure

The key chapter for every sample nonprofit gift acceptance policy is a gift’s approval procedure. Basically this policy’s chapter shall represent a detailed step-by-step guide an individual shall follow when disclosing an obtained gift or seeking an approval. In this regard, the text of the policy should provide:

- means of communication with a compliance manager to whom requests should be sent (e.g., email, phone number); and

- timeline for sending the request.

Amendment Policy

The text of a nonprofit gift acceptance policy shall lay out the amendment process, in particular:

- the frequency of a policy’s review, for instance, every month or every year; and

- the process of notifying the organization’s staff, employees, and members about introduced amendments.

How to customize a policy template at Faster Draft?

To get a fully personalized sample gift acceptance policy, follow a few easy steps below:

- Click the button “Create Document.”

- Answer simple questions in the form.

- Select a template’s format—gift acceptance policy PDF or Word.

- Make a payment.

- Download and use customized templates in minutes.

Table of content

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates