Debt Acknowledgment Letter

Reviews

What is a debt acknowledgment letter?

A debt acknowledgment letter is a formal written document in which a debtor confirms and accepts the existence of a debt owed to a creditor. This letter serves a dual purpose. First, it serves as legal evidence of a debt’s acknowledgment by a debtor. Second, this letter becomes solid legal proof in case of any future dispute between a creditor and a debtor.

The parties involved in a debt confirmation letter are

- debtor (a person who owes the money and reconfirms the debt); and

- creditor (a person, business, or organization that shall receive the repayment of a debt).

A creditor in a letter should not necessarily be a creditor under the original loan agreement or promissory note. If, for instance, a creditor has assigned their rights and obligations to a third party, then this letter shall be written in the name of that other third party.

This document not only prevents disputes by clearly recording the debt but also provides protection to both parties by ensuring that the terms of acknowledgment are transparent and verifiable.

Debt Acknowledgment vs. Debt Settlement

It is common to confuse a personal debt acknowledgment letter with a debt settlement agreement. This is because both documents deal with a settlement debt between a creditor and a debtor. However, those two documents serve a different purpose:

A debt acknowledgment letter is a written confirmation of a debt. A creditor is not involved in signing this document. The sole fact of acknowledgment of a debt does not change the provisions of the original loan agreement or promissory note. In other words, an acknowledgment letter is a mere confirmation of a debt, without forgiving or changing it.

A debt settlement agreement is a bilateral agreement that both a creditor and a debtor shall sign. A settlement agreement aims to define new conditions of a debt repayment. In other words, this document focuses on changing the original repayment schedule of a debt. Usually, this document tends to modify the sum of original debt by, for instance, reducing an interest rate or removing penalties.

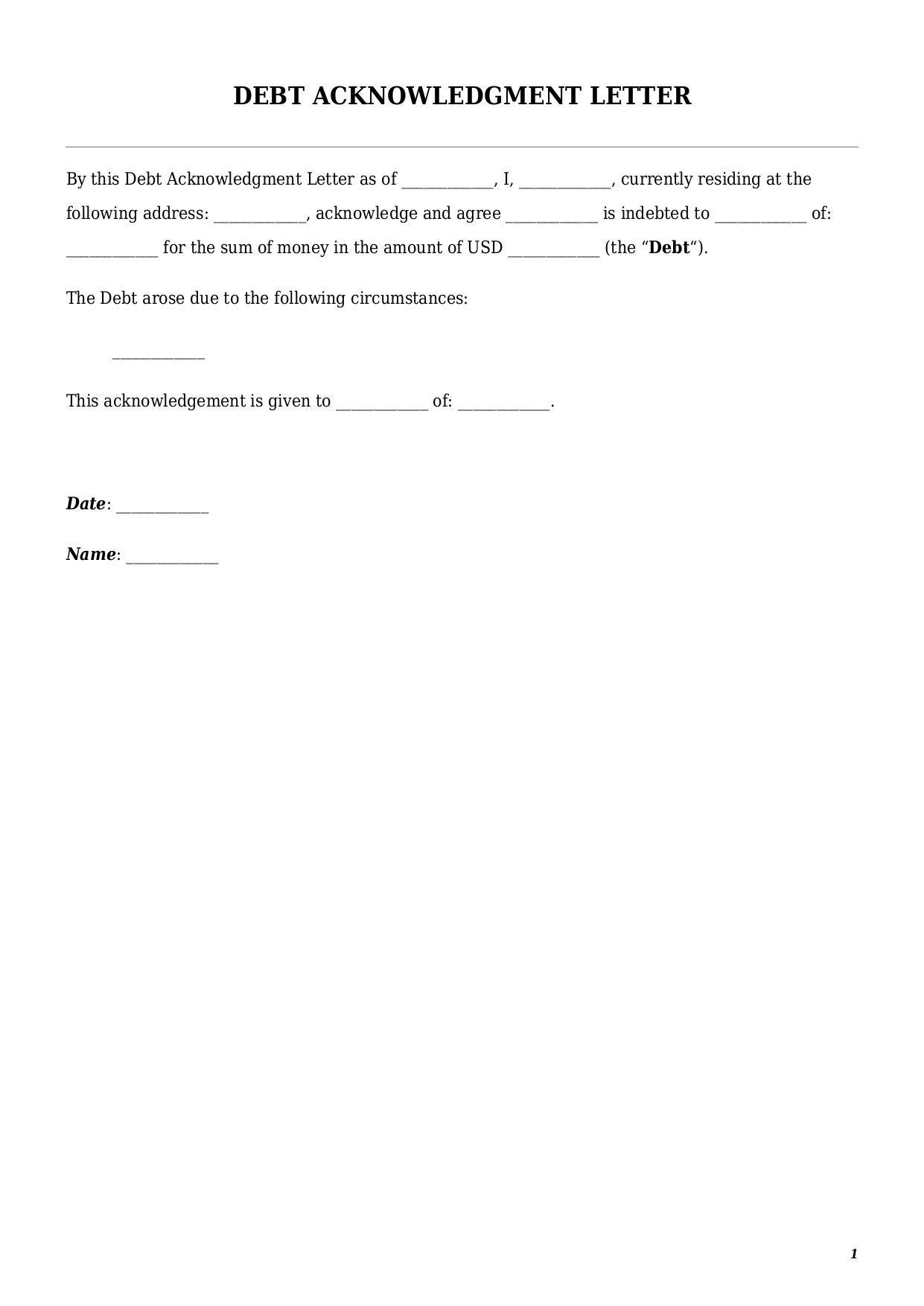

How to draft a debt acknowledgment letter?

Drafting a debt acknowledgment letter is a straightforward process. However, failure to include a number of important details may result in a document being incomplete. Below we made a short summary of information you have to include in a letter template:

- Details of the debt

The key component of every debt acknowledgment letter sample is the inclusion of the debt details. Thus, the debtor has to include the details listed below:

total amount of the debt (i.e., not only the principal debt amount but also any accrued interest and penalties, if any);

grounds by virtue of which the debt occurred (e.g., signed loan agreement, promissory note, or provision of certain services under a services contract); and

any other additional information related to the debt, if any (e.g., a force majeure event that prevented the debtor from making repayment on time).

- Party Details

The text of a debt confirmation letter shall state clearly the details of a debtor and a creditor, including their full name and address.

- Date and signature

To be a valid legal document, the acknowledgement of debt letter must be signed by the debtor. It is possible to use online e-signature tools to sign a document or to sign it by hand. Both ways of signing are acceptable. Along with a signature, the date of signing the letter should also be included.

Once the letter is ready, it shall be sent to the creditor. There is no mandatory way for how a debtor shall send the letter. Therefore, a debtor can pick up any method of sending they prefer—e.g., via email, by post, or delivery in person.

How to customize a letter template at FasterDraft?

To get a fully customized letter template, follow a few easy steps below:

- Click the “Create Document” button.

- Answer simple questions in the form.

- Select a template’s format—Debt Acknowledgment Letter PDF or Word.

- Make a payment.

- E-sign, download, print, and instantly use this document.

Table of content

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates