Articles of Incorporation

Reviews

What are articles of incorporation?

Articles of Incorporation are the primary corporate formation documents required to legally create a new corporation in the United States. In plain legal language, this document acts as the corporation’s official “birth certificate.” By customizing this document, you can create articles of incorporation nonfprofit or for-profit corporation in several minutes.

The template articles of incorporation define essential information about a company, including its name, purposes, business address, shares, type of corporation, etc. Having an articles of incorporation template is a first step towards the registration of a corporation. Once it is registered, your corporation gets instant access to an unlimited number of benefits, including bank accounts, stock markets, insurance protection, etc.

The importance of a sample articles of incorporation cannot be overstated, as it is helpful for various purposes:

- First, once the document is filed with the secretary of state, a corporation is officially created.

- Second, it defines key elements of a corporation’s structure.

- Third, your corporation becomes legally recognized for doing business in the U.S.

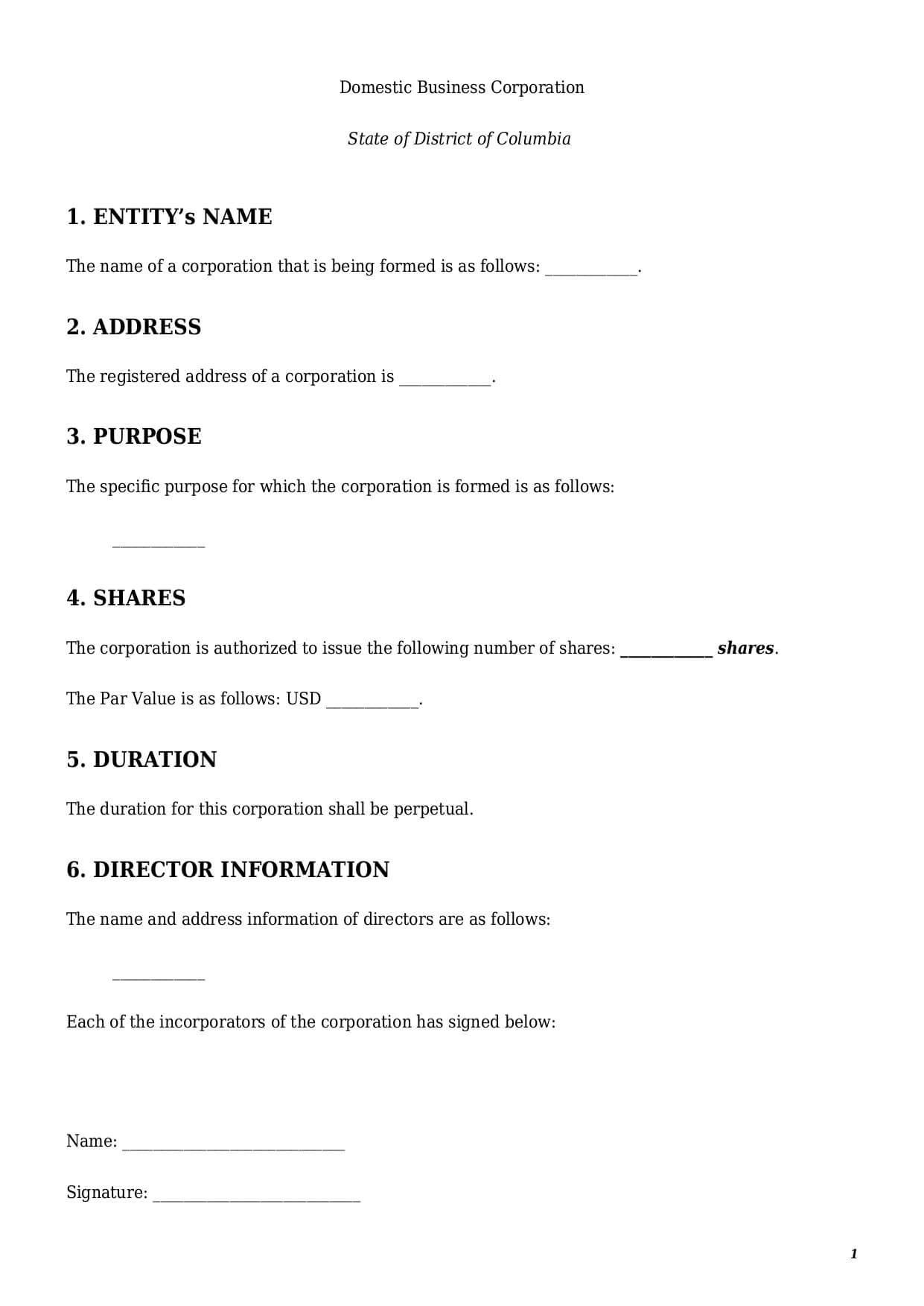

What should be included in a sample of articles of incorporation?

Creation of articles of incorporation is not an easy task, as it requires attention to detail and full compliance with applicable state registration. Besides that, the sample articles of incorporation nonprofit differ significantly from the same document created for a for-profit corporation. All in all, below we prepared a short guide on how to create articles of incorporation in the U.S. from scratch.

State of Incorporation

Selection of a state for a company’s formation is, by far, the first and the most important step. It not only defines the exact format of a final sample article of incorporation but also the applicable tax regime and benefits.

Depending on the selected state, the document’s title may also differ. For example, articles of incorporation for nonprofit or for-profit corporations in Alabama are named as “Certificate of Formation.” While in the Articles of incorporation California, the document is being named as “Certificate of Incorporation.”

All in all, a good articles of incorporation example includes the full document’s title as per applicable state legislation and the direct reference to the name of a state.

Corporate Name

Another key element for all articles of incorporation templates is a corporation’s name. This is where shareholders and incorporators are able to show their creativity and come up with a distinctive company name. However, we recommend checking in advance the following information:

- Tip 1. Make sure that there is no other company with a similar name already registered in a state where you plan to create your own corporation. To do that, use the free company search available on the official website of every state registrar.

- Tip 2. Avoid inclusion of offensive words or restricted words like “federal,” “state,” “governmental,” or other similar words that mislead or confuse the public. For example, on the California State Registrar’s official website.

- Tip 3. If a corporation will perform any professional activity (e.g., legal, accounting, trustee), make sure its name reflects its professional nature.

- Tip 4. When you create sample articles of incorporation nonprofit, in that case a company’s name should also reflect its nonprofit nature.

Corporation’s Type and Purpose

A sample of an article of incorporation could be of two main types:

- a corporation for profit; or

- a nonprofit corporation.

The main difference between those two types lies in the ability to distribute profit and dividends amongst shareholders. If you need a non profit articles of incorporation template solely for religious, charitable, or scientific activity, in that case the text of a document must also include an IRS statement. This is a standard disclaimer by which founders undertake to not participate in any sort of business activity using a corporation.

Despite a corporation’s type, template articles of incorporation should also state its purpose. Here founders must state one or several key activities a corporation wants to perform. There is no need to list all possible or collateral activities.

Registered Office Address

Every company must have an official business address, and a corporation is of no exception. This address defines a corporation’s location, and this is where all official correspondence from courts, tax authorities, and other state or federal bodies is being sent. You can select any address within a state where a corporation is being registered. It could be your home address, rented office space, or even garage.

If a mailing address differs from a registered address, then the article of incorporation template must reflect the same.

Duration

A solid template articles of incorporation nonprofit or profit shall also reflect the period of time within which a corporation shall operate. Legislation in most of the states provides that a corporation is created for an indefinite period of time, until dissolved by its members or by a state.

However, in states like Kansas, Mississippi, New Jersey, New Mexico, and some others, a corporation’s lifespan should be limited in time. Thus, the articles of incorporation sample must define either a date in the future or a list of events upon the occurrence of which a corporation should be dissolved.

Appointment of Directors

In the case of a template articles of incorporation nonprofit, the daily management of a corporation could be vested into the hands of shareholders or directors. This is something that founders must decide on when drafting this document. If directors shall manage a corporation’s daily affairs, then the text of a document shall define their number, full names, and contact details. The state law does not define the maximum number of directors a founder could appoint. However, the average number is between 1 and 5.

For a sample of articles of incorporation of a for-profit corporation, inclusion of directors is mandatory.

Share Structure

This section is only applicable for a for-profit articles of incorporation template and defines the following important components:

- types of shares to be issued (e.g., common share only or both common and preferred shares);

- par value or nominal value of each share in U.S. dollars;

- list of series of issued shares (applicable only when both common and preferred shares are issued).

How to sign the articles of incorporation template?

After the document is complete, it should be signed to be legally valid. Without signatures, a further registration of a corporation is not possible.

Either the corporation’s founders or other third parties could sign. Founders are individuals or entities who wish to create and run a corporation. In other words, they are future shareholders once the corporation is registered. Incorporators are any other individuals or entities who help to prepare documents and file them for a corporation’s registration. It could be an attorney or any other person acting by virtue of a power of attorney.

The text of a document must reflect the full name of each person who signs this document, along with their signature.

How to customize the articles of incorporation template?

To get a fully customized legal document, follow the instructions given below:

- Click the “Create Document” button.

- Answer simple questions in the form.

- Select a template’s format—a sample of articles of incorporation PDF or Word.

- Make a payment.

- Download, print, sign, and file the document with the state registrar.

Table of content

Frequently Asked Questions (FAQ)

-

1. What information is required for Articles of Incorporation?

The exact list of information required to file an article of incorporation sample varies depending on each state, as well as the type of corporation created—for-profit or non-profit.

For instance, for articles of incorporation samples in Arkansas, shareholders must include the full name and contact details of a contact person who files the document with a state registrar. However, this is not the case for other states like Nebraska or New Hampshire.

-

2. Do I need a lawyer to file Articles of Incorporation?

Once an article of incorporation template is finalized, it should be filed further for state registration. The persons listed below could file all requested documents:

- one of a corporation’s shareholders; or

- incorporator (i.e., a person who participates in the preparation of all required documents but is not a shareholder).

-

3. What is the difference between Articles of Incorporation and Bylaws?

Articles of incorporation are an essential and mandatory document required for the registration of a corporation in the U.S. This document is also a public document, which means that its copy is being kept in a state registrar’s records. Contrary to that, corporate bylaws are an internal corporate document that is being used to define the internal managerial and organizational structure of a company.

Apart from that, while the articles of incorporation sample is being used only for corporations, bylaws usually cover all types of for-profit companies in the U.S., including C-corps, S-corps, and limited liability companies.

-

4. Can this template be used in any U.S. state?

Yes, this sample of articles of incorporation could be customized for all 50 states and the District of Columbia. The template includes minimum state requirements to register a corporation.

-

5. What happens after filing Articles of Incorporation?

Once the articles of incorporation template is filed with the state registrar, incorporators must wait for a specified period of time to complete a corporation’s registration. The timeline for registration differs depending on each state. For example, in the state of New York the formation process could take up to several weeks, while in Illinois it could last up to 1 month.

The good news is that most states offer a speeded-up registration process for a corporation upon the payment of additional fees.

After the process is complete, you will receive a copy of your articles of incorporation with a state registrar’s stamp confirming the date of registration and a corporation’s registration number.

-

6. Is this template suitable for nonprofit corporations?

Yes, this corporate articles of incorporation template could be used for both types of corporations—for-profit and nonprofit. If, however, you are planning to set up a nonprofit charitable or religious organization, another template should be used instead.

-

7. What is par value in Articles of Incorporation?

The par value of a share is the minimum value of each corporation’s share. The law defines that par value cannot be less than 1 cent. At the same time, there is no maximum threshold for the par value of a share.

Information regarding the par value of a share is a key element of every corporate articles of incorporation template. It could directly affect the distribution of dividends between the shareholders in the future.

-

8. What is a sample articles of incorporation LLC?

There is no such thing as a sample articles of incorporation LLC. The truth is that article of incorporation could be used only for companies created in the form of a corporation (C-corp or S-corp). In the case of an LLC, articles of organization should be used instead.

-

9. What are the requirements for articles of incorporation California?

A well-drafted articles of incorporation California must include the following details:

- corporation’s name, business address, type, and purpose;

- name and address of a registered agent;

- number of shares, types of shares, and their par value (not applicable for nonprofit articles of incorporation template);

- number of shareholders and their names (not applicable for nonprofit articles of incorporation template);

- name and contact details of incorporators;

- full name and contact email address of a person who submits this form;

- signatures of incorporators.

-

10. What are the requirements for the state of Illinois articles of incorporation?

There are no specific requirements that differ significantly in articles of incorporation for Illinois from other states. There are a few peculiar details that must be included, however, in a sample articles of incorporation:

- In the case of a nonprofit corporation, the text of a document must clearly state the exact purpose (e.g., charitable, religious, etc.); and

- Full name and contact details of a person who files this form to the state registrar.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates