Debt Settlement Agreement

Reviews

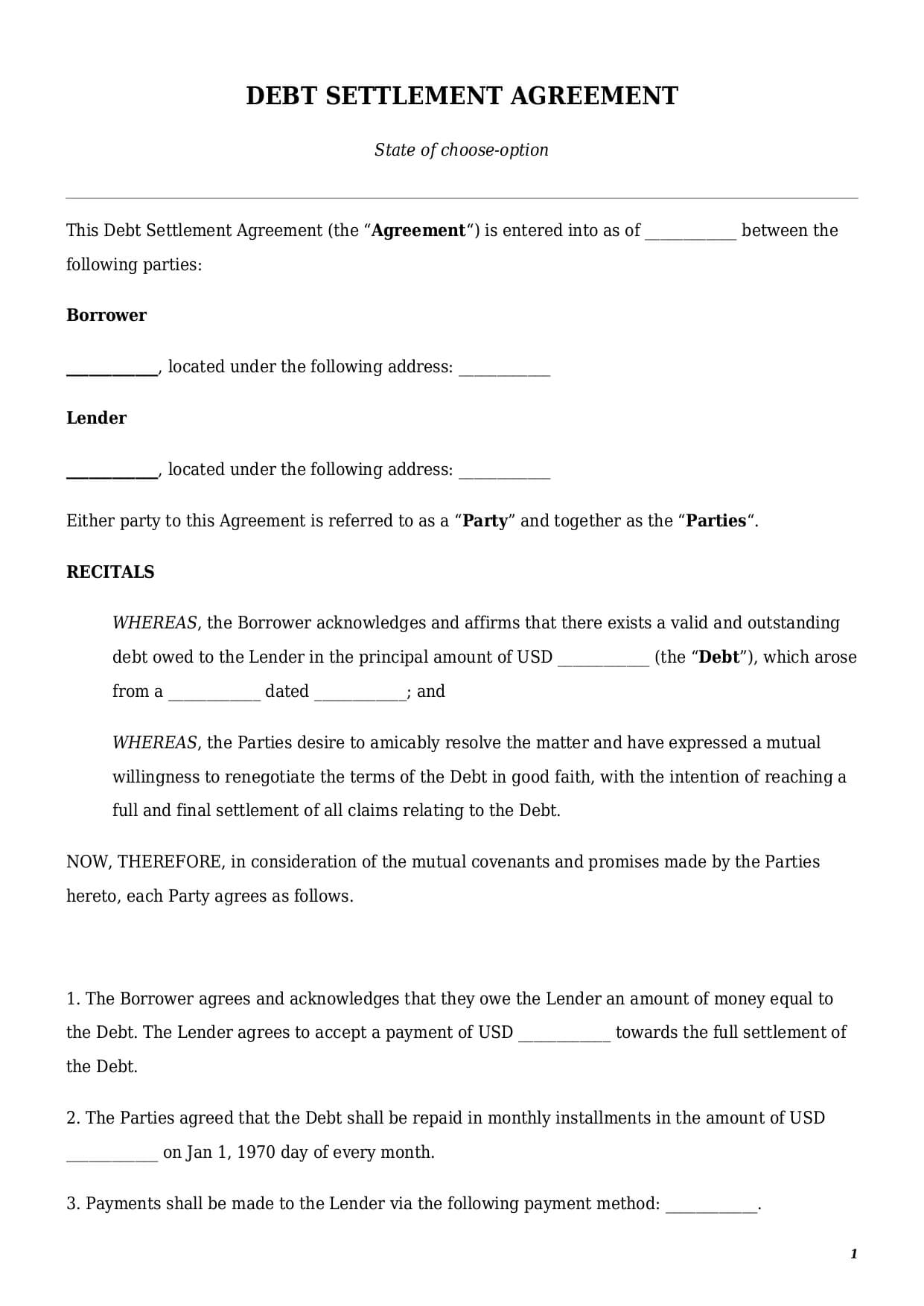

What is a debt settlement agreement?

A debt settlement agreement is a legally binding contract between a borrower and a lender that outlines the terms under which an outstanding debt under a loan agreement shall be resolved.

This template allows parties to renegotiate the terms and conditions of an original loan in order to settle down an existing debt. This document is the last resort to settle the existing debt before proceeding to legal actions.

This document helps formalize a mutual agreement to settle the debt through a one-time payment or a structured repayment plan between a creditor and a debtor.

There are, however, a number of situations in which a debt settlement agreement CANNOT be used, for instance:

- if a bankruptcy case is opened against a borrower;

- in case of a student’s loans;

- if there is an existing court judgement dealing with the same debt settlement.

A debt settlement agreement format requires two parties to be involved—a borrower and a lender. A borrower is a person under an original loan agreement or promissory note that has an existing debt before a lender. A lender, also referred to as a creditor, is a person who borrowed money under the loan agreement or promissory note.

How to draft a debt settlement agreement template?

A well-drafted debt settlement agreement template helps to enforce clarity, protects both parties, and prevents any potential disputes in the future.

Missing one or several key components may affect a debt settlement agreement’s validity and legal enforceability. We made a short breakdown of the most essential clauses a good debt settlement contract shall have:

Details of Original Loan

Every debt settlement agreement contract shall provide the details of the original debt, including:

- the full name of an original contract (e.g., personal loan agreement, promissory note) and its date;

- the amount of the loan and its currency; and

- interest (if applicable) and original repayment schedule.

Acknowledgment of Debt

The text of a debt settlement agreement contract shall also include an acknowledgment of the original debt by a borrower. Apart from that, the parties have to reach an agreement about the new final amount of debt a borrower shall pay.

Settlement Terms

Every debt settlement agreement sample shall provide how exactly the final debt amount shall be paid by a borrower. There are several options the parties can pick:

- first, repayment on a specific date in full;

- second, partial repayment in installments (e.g., weekly, monthly, or annual); or

- third, repayment within a specific period of time in full after receipt of a written lender’s demand.

Settlement terms in a debt settlement agreement sample shall also define the payment method using which a borrower shall pay (e.g., cash, automatic bank withdrawal, etc.).

Additional provisions

A solid payment settlement agreement sample shall also contain:

- mutual release claims (i.e., once the debt is settled, neither party will pursue further legal claims related to the original loan);

- confidentiality (the parties may wish to keep all information about the debt settlement confidential); and

- governing law (the parties have to choose the laws of a state that shall govern any future disputes arising from a debt settlement agreement).

How to customize a contract template at Faster Draft?

To personalize your debt settlement contract, follow a few easy steps below:

- Click the button “Create Document.”

- Answer simple questions in the debt settlement agreement form.

- Select a document’s format—debt settlement agreement PDF or Word.

- Make a payment.

- Download, print, sign, and use your customized template in seconds.

Table of content

Frequently Asked Questions (FAQ)

-

1. Can I make a debt settlement agreement letter instead of a contract?

A letter is an official document in which one party provides the other party with some important information. A letter shall be signed by a person who sends it or by its official representative.

A contract is an official document by which two or more parties mutually agree to create, amend, or cease the existence of certain rights or obligations. A contract shall be signed by both parties to be valid.

If the parties wish to settle an existing debt under a loan agreement, they can do so only by signing a respective contract. In other words, both a lender and a borrower shall agree to settle a debt in a certain way. Once the parties make an arrangement, such an arrangement shall be put on paper in the form of a contract.

It is not possible to send a debt settlement agreement letter to a borrower demanding a settlement of a debt on terms and conditions a lender solely wishes to impose.

-

2. How to sign a debt settlement agreement?

A debt settlement contract can become a legally binding contract only upon its signing by both parties—a lender and a borrower. Both parties have to put their signatures either by hand on a printed document or using an e-signature tool on a document’s PDF or Word file.

Neither federal nor state laws require parties to notarize their signatures.

If an original loan agreement is secured by a guarantee, in that case a guarantor has to agree to the debt settlement too. Failure to do so may result in automatic termination of a guarantee or its inapplicability towards the new debt settlement arrangement.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates