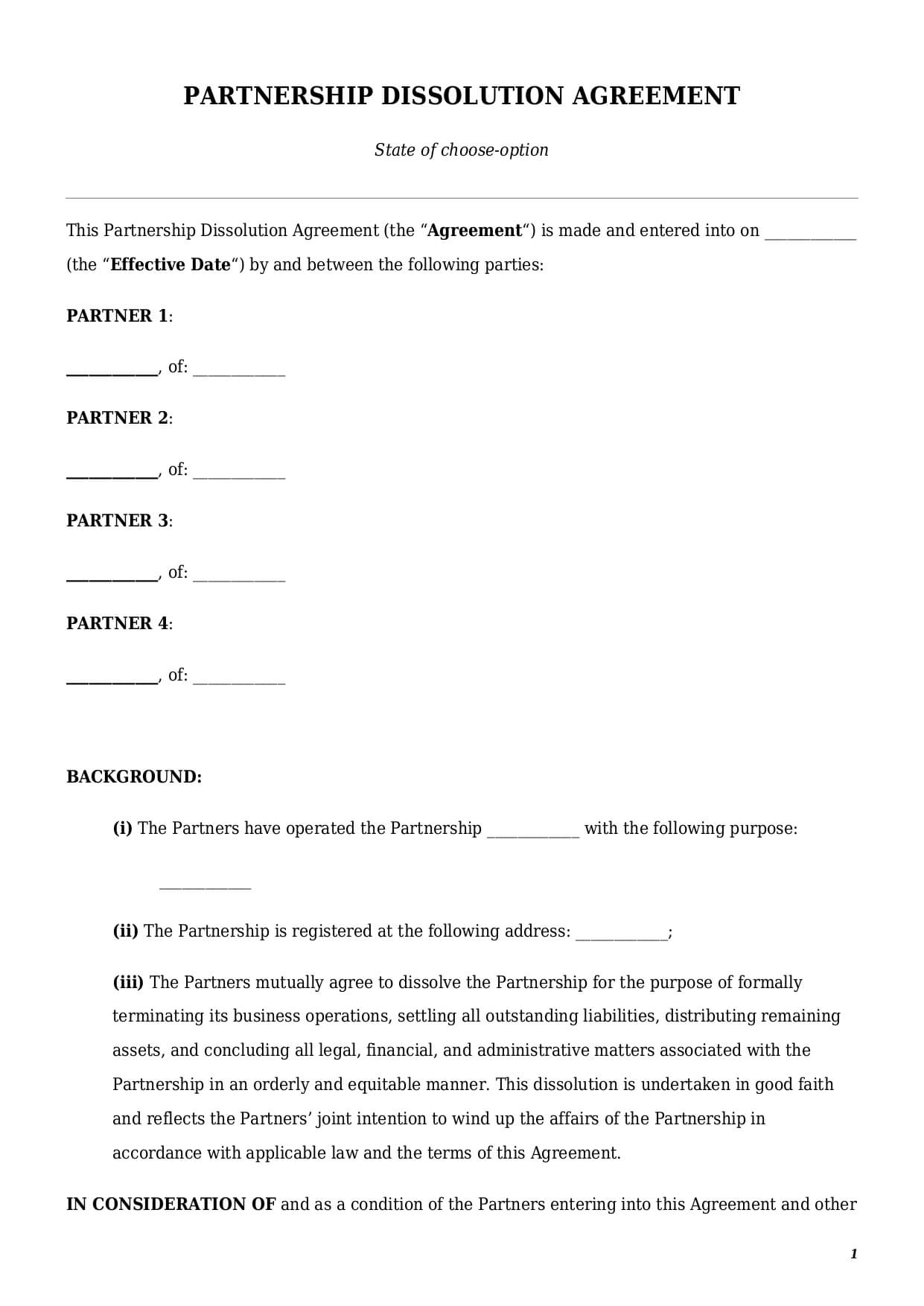

Partnership Dissolution Agreement

Reviews

What is a Partnership Dissolution Agreement?

A partnership dissolution agreement is a legal document used when two or more partners decide to formally end a business partnership. This contract template outlines:

- details of partners who sign the document;

- reason for termination;

- partnership’s name and address;

- appointment of a liquidating partner;

- appointment of an accountant;

- distribution of remaining assets and liabilities; and

- other miscellaneous provisions.

The present dissolution of partnership agreement template can be used for a voluntary termination of a partnership by all partners. It could be used to end a general partnership, limited partnership, or limited liability partnership operating in the United States.

How to draft a partnership dissolution agreement template?

Creating a partnership dissolution agreement template might be a daunting task. Below we made a list of the most essential elements a solid partnership dissolution agreement template shall definitely include.

Appointment of Liquidator

Every dissolution agreement of partnership template shall include information about the appointment of a liquidator. This is a person who shall be responsible for winding up the partnership.

A liquidator could be one of the existing partners or a neutral third party. Under a partnership dissolution agreement, a liquidator shall have the right:

- to sell business assets;

- to collect outstanding receivables;

- to use the proceeds to pay off debts, etc.

Neither federal nor state law requires or provides any information regarding a liquidator’s compensation. Therefore, it is up to the parties of a partnership dissolution agreement to decide how a liquidator’s compensation shall be paid, if any. If, however, the partners decide to pay, there are several available compensation models they can pick from:

- a fixed lump sum;

- a regular allowance (weekly or monthly);

- compensation of incurred expenses (e.g., transportation, printing);

- any other arrangement.

Appointment of Accountant

A well-drafted dissolution agreement of partnership template shall appoint an accountant for a liquidation process. An accountant shall be in charge of all financial aspects related to winding up the business. The accountant’s responsibilities shall include preparation of final financial statements, tax filings, and ensuring proper valuation of assets.

The account could be:

- one of the partners, provided he or she possesses the necessary financial and accounting background;

- professional accountant or accounting firm.

Publication of Dissolution in Newspaper

According to the local legislation of most states within the United States, a notice of a partnership’s dissolution shall be published in a local newspaper. Such a publication is needed to inform third parties that a partnership ceases to exist. This might be particularly important for creditors, clients, or other interested parties.

Such a notice shall be published in all local newspapers within the state where a partnership mostly conducts their business. The same clause should be incorporated in the text of a final dissolution agreement template.

Usually, the text of a partnership dissolution agreement appoints a liquidating partner who shall be in charge of making such a publication.

Allocation of Remaining Assets and Liabilities

The most essential component of every sample partnership dissolution agreement is an allocation of remaining assets, if any. Once the partnership settles all debts and obligations before their creditors and third parties, certain assets may remain. Those assets may include cash, vehicles, equipment, other movable property, and even IP rights.

Therefore, the partners shall decide how exactly those remaining shall be distributed between them. And here there are few options:

- First, all remaining assets could be split up between the partners in equal shares.

- Second, the remaining assets could be divided pro rata to each partner’s contribution.

- Third, in any other way agreed upon by all partners.

Partners shall keep in mind that if the original partnership agreement provides a specific way of allocation of remaining assets in case of liquidation, then such way of allocation shall be used.

A good partnership dissolution agreement sample should also take care about allocation of any remaining liabilities. Basically, the parties may use the same allocation methods as for the distribution of remaining assets. It is a good business practice to include an indemnity clause to protect each partner from post-dissolution claims.

How to customize a legal document template at Faster Draft?

In order to customize your business partnership dissolution agreement, follow a few easy steps below:

- Click the button “Create Document.”

- Answer simple questions in the questionnaire.

- Select a document’s format—Partnership Dissolution Agreement PDF or Word.

- Make a payment.

- Download, print, and sign your personalized legal document template in seconds.

Table of content

Frequently Asked Questions (FAQ)

-

1. Can I use a dissolution of partnership agreement for my domestic partnership?

No, this dissolution of partnership agreement can be used exclusively for winding up a business structure in the form of a general, limited, or limited liability partnership.

For marriage dissolution or dissolution of a domestic partnership, check our section with family documents.

-

2. What is a dissolution of a partnership?

A dissolution of a partnership is a legal process as a result of which a partnership ceases to exist. The decision to dissolve the partnership can be adopted by:

- the partners;

- by a court order (e.g., in case of a partner’s deadlock);

- by a secretary of state (e.g., failure to pay taxes).

The dissolution of a partnership by partners is also known as a voluntary dissolution. The present dissolution of partnership agreement template can only be used by partners who wish to wind up a partnership.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates