General Partnership Agreement

Reviews

What is general partnership in business language?

A general partnership is a business arrangement between two or more individuals willing to run a business together and split up jointly profits, losses, and liabilities. A general partnership could be formed for any type of business activity.

It is a widely used tool between entities and individuals willing to set up a business vehicle without additional involvement of a state.

A general partner can be anyone—a physical person, trust, start-up, corporation, or even government.

The formation process is relatively fast and easy since it does not require state registration or other administrative formalities. The general partnership is considered to be formed once all necessary documents, including a general partnership contract template, are signed.

In order to form a general partnership, parties do not necessarily need a written general partnership agreement. Even though a partnership agreement could be concluded orally, it is always a good practice to put everything on paper in order to avoid possible disputes in the future.

Forming a general partnership with a personalized general partnership agreement allows you and your partner to decide on the following:

- Exit strategy from the partnership;

- Share division of profits between all partners;

- Decision-making process and split of responsibility for adopted decisions and many more.

What is the difference between a general partnership and a corporate business entity?

There are a number of reasons that help to differentiate a general partnership from other corporate business ventures as limited companies, corporations, etc.

For those starting a business for the first time, forming a general partnership might be a simpler solution. While every corporate business entity should be further registered with state registrar, there is no such requirement for a general partnership.

Division of debts and obligations is another important cornerstone. Despite the selected type of corporate business entity, there is always a clear delimitation between business debts and personal debts of their members or shareholders. However, this is not the case for a general partnership, as all general partners are personally liable for all debts and losses of the partnership.

General Partnership: Advantages and Disadvantages

Before evaluating all general partnership pros and cons, it is crucial to understand the goals you plan to pursue. If you are looking for simplicity of management and operation, in that case a general partnership might be a good choice for you. If, however, you are looking for a more sophisticated business structure, including hiring employees and scaling business, then a general partnership seems not to be the right choice.

Benefits of General Partnership

There are a number of general partnership benefits:

Easy to Form

In order to start a business as a general partnership, there is a minimum number of steps to accomplish before the actual start. You would need to have at least two partners and a general partnership agreement contract. There is no obligation to keep accounting or undergo an annual audit.

Though if you do plan to hire personnel or to perform certain types of licensed activities, additional steps need to be fulfilled. In particular:

- Get your EIN if you plan to have at least one employee.

- Get your license if you plan to perform an activity that is licensed in your state, apply for the license first.

- Register your fictitious business name if you plan to perform business activity under a specific name.

Straightforward Winding Up

It is as easy to dissolve the partnership as to form it. Usually a dissolution of a general partnership takes the form of a dissolution agreement signed by all partners. There is no further submission of filing required to close the partnership.

There are certain cases when dissolution of the partnership happens by default, for instance:

- If a general partner dies; or

- If a general partnership has a dissolution date written up in a general partnership agreement.

Partners are free to include any other circumstances upon which a general partnership should cease to exist.

Disadvantages of General Partnership

Lack of Financial Resources

The business structure in the form of a general partnership does not allow partners to borrow money from banks or financial institutions in the partnership’s name.

Besides that, there is no way to expand your business further by soliciting additional capital from new investors or issuing new shares.

Lack of Protection for Business Owners

One of the biggest downsides of the general partnership is unlimited liability of partners. The partners’ personal assets, like real estate or savings, could be used to cover the debts and liabilities of the partnership itself.

Unlike a limited liability partnership or any other corporate business structure, the liability of partners in a general partnership is not limited to any specific percentage or share. As a general rule, all partners are jointly and severally liable for all debts of a partnership. Even if the split of profit generated by a general partnership is not equal, it does not affect the scope of unlimited liability.

Lack of Uniform Management

In a general partnership, each partner can act in the name of such a partnership—e.g., enter transactions or sign documents. However, the consequences of taking such steps will be shared by all the other general partners in full. Therefore, it is essential to agree on how partners will decide regarding daily operations of the partnership. This is where having a simple general partnership agreement would be helpful.

General Partnership Taxation

A general partnership is considered to be a pass-through entity for the purpose of taxation. There is no partnership tax. Though it does not mean that general partners are being exempted from taxation.

All taxes are being paid at the level of a general partner. The model of taxation for a general partnership resembles taxation for a sole proprietorship. In fact, all the income should be reflected in the individual personal income statement.

When forming a general partnership, partners have to consider the following tax considerations:

- A general partner pays personal income taxes only on their partner’s share in generated profit.

- A tax liability for paying personal income taxes might arise before a partnership’s actual profit is distributed amongst partners.

- A profit received from a general partnership could not be deducted from taxable income as certain expenses.

- Every state in the USA has their own rules regarding taxation of general partnerships. In some cases, a profit obtained through general partnership is considered as a personal income. Thus, personal income taxes should apply. In other instances, a general partner is considered self-employed; thus, rules other than personal income taxation should apply.

- Every general partner should submit annually a Schedule K-1 form to report any profits and losses. This is a direct requirement of the IRS.

Is it worth it to get your General Partnership Agreement Template for free?

Using a general partnership agreement template available online for free might sound appealing. Though we won’t recommend doing so, here is why.

A free online example of general partnership agreement is not tailored for your needs. If a document works for one business venture, it won’t necessarily work the same way for another.

A free template won’t reflect the needs of your future business and composition of partnership. If the selected general partnership agreement sample has worked for one person in the past, it does not necessarily mean that you will benefit from it as well.

Since all general partners remain personally liable for the decisions of each other, it is essential to define thoroughly how partners will manage a partnership on a daily basis. Without doing so in each particular case, a person might end up in a situation when he or she would be liable for a partnership’s liability without making any decisions in the first place.

Table of content

Frequently Asked Questions (FAQ)

-

1. What is a general partner?

A general partner is an individual or corporate entity that participates in a general partnership. Unlike a limited partner in a limited liability partnership, a general partner has unlimited liability towards all debts and obligations of a general partnership.

-

2. What is a general partnership definition?

A general partnership is a business structure formed by at least two individuals willing to perform business together and which is characterized by unlimited liability of all partners.

-

3. How to register a general partnership?

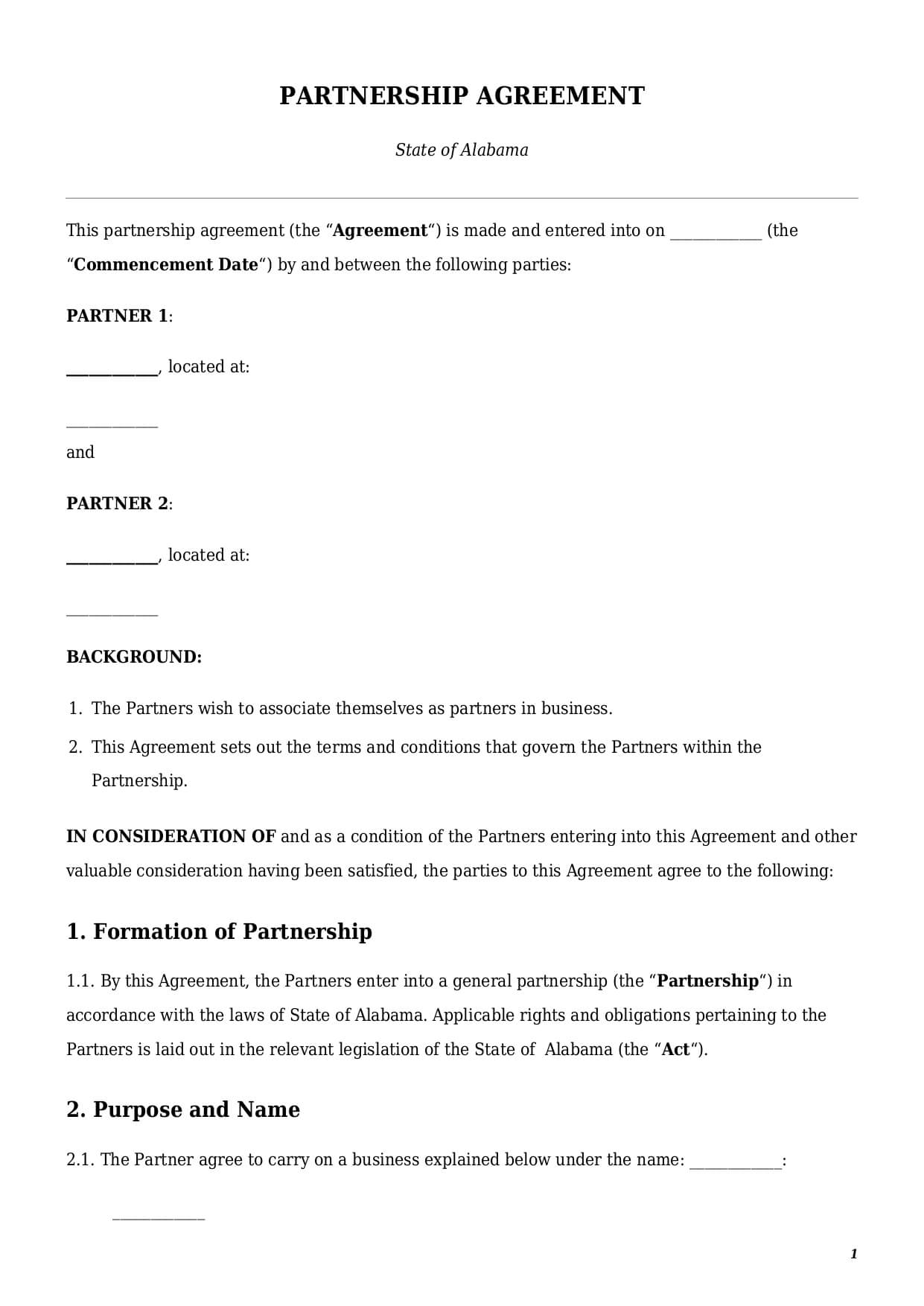

The process of general partnership formation is very simple. Once you decide on who will become general partners, the next step is to sign a general partnership contract. Once it is done, a partnership can start performing its business activity.

-

4. What should be included in a general partnership agreement?

A simple general partnership agreement template should contain the following essential clauses:

- Distribution of profits and losses;

- Daily management and operation of a general partnership;

- Withdrawal from a general partnership;

- Dissolution of a general partnership.

Despite the number of general partners, deadlock situations may happen along the road. A good example of a general partnership contract sample should also contain a dispute resolution clause.

-

5. How is a profit divided in a general partnership?

A partner’s distributive share in a profit allocation depends on their initial contribution to a general partnership. Partners, however, can set up other rules for profit’s allocation inside a general partnership agreement.

-

6. How to explain general partnership liability?

A general partnership constitutes a specific legal structure according to which all general partners are personally liable for the partnership’s obligations. It basically means that a general partner is fully liable for the duties of a general partnership in full.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates