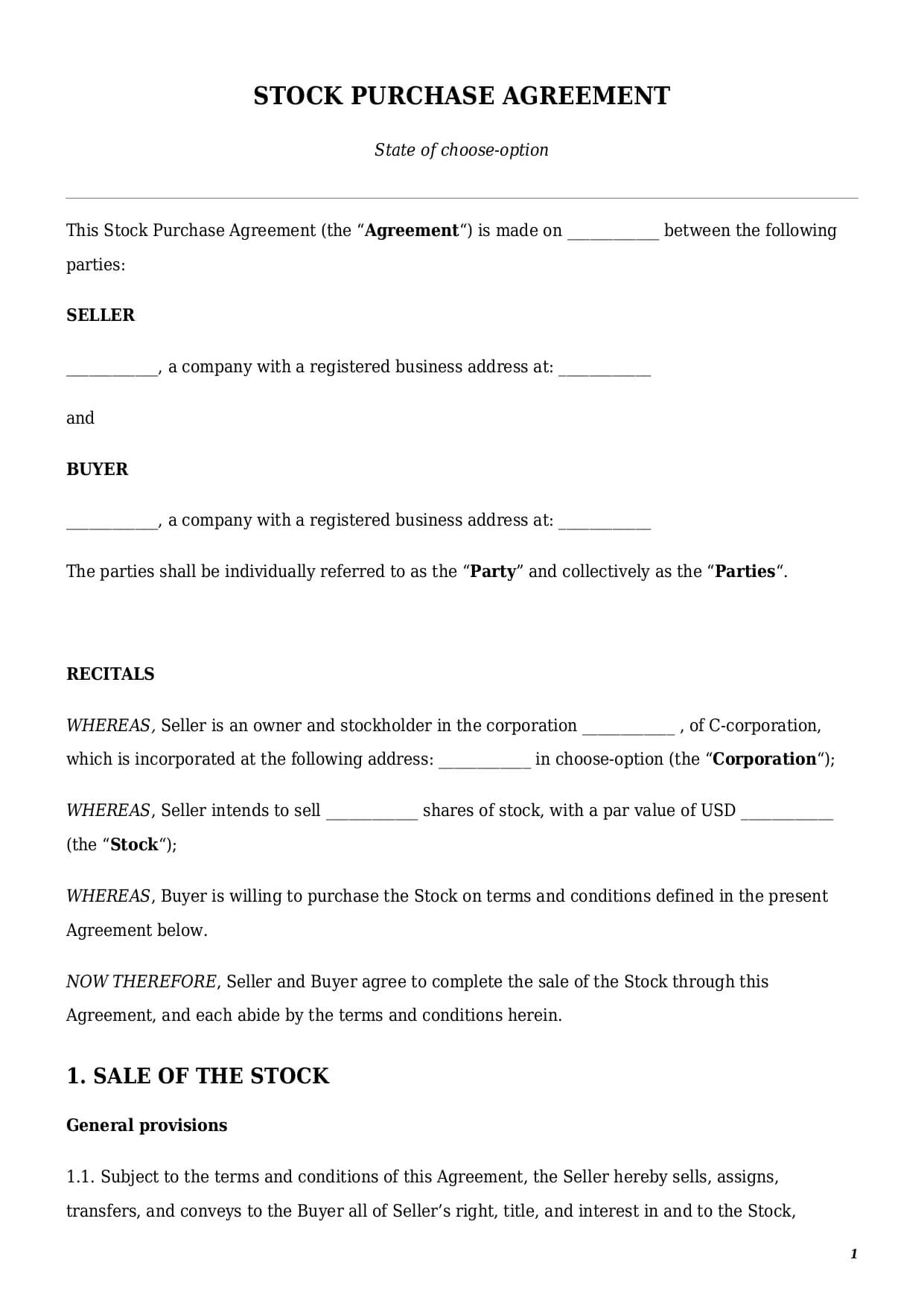

Stock Purchase Agreement

Reviews

What is a stock purchase agreement?

A stock purchase agreement is a legally binding contract under which a seller transfers shares of stock to a buyer in exchange for consideration. A solid stock purchase agreement example shall define:

- full names and addresses of parties involved;

- details of the description of shares and the corporation;

- each party’s representations and warranties;

- seller’s confidentiality obligation;

- conditions for a transfer of stocks;

- payment provisions;

- closing date and procedure;

- miscellaneous provisions (e.g., applicable law, indemnification, severability, etc.)

Parties to a sample stock purchase agreement are the seller and the buyer. The seller could be of two types:

- a corporation itself that wishes to assign their shares; or

- a stockholder that currently holds stocks in a corporation. A stockholder could be an individual, legal entity, or business.

The buyer who enters a stock sale agreement form could also be an individual or a legal entity. Depending on the type of corporation, not all individuals or businesses could acquire stocks. For example, stocks of an S-corporation cannot be held by foreign companies or individuals. This is because profits coming from an S-corporation’s activity are taxed at the level of their stockholders. Apart from that, the maximum number of shareholders an S-corporation shall not exceed 100. Therefore, selling newly issued shares to more buyers will make a final transfer void.

The present stock sale agreement form could be used to transfer shares of C-corporations and S-corporations. If you need to transfer an interest in the limited liability company (LLC), in that case an LLC Membership Purchase Agreement shall be used instead.

How to draft a stock purchase agreement sample?

Drafting a stock purchase agreement sample could be a challenging task. It is essential to cover all mandatory elements to make sure the final document is complete, clear, and incorporates all parties’ previous arrangements. Below we made a short checklist of all mandatory components a solid stock assignment agreement should have.

Details of Stocks Purchased

Every stock assignment agreement shall specify all the details related to the stocks being transferred, including:

- exact number of shares;

- par value of one share in USD;

- type of shares (preferred or common); and

- class of shares (if applicable).

If a seller assigns only a portion of the shares they hold in a corporation, the text of a document should clarify the same.

Transfer Limitations under Shareholder Agreement

The first thing every buyer shall check before signing a stock sale agreement is if a seller is a party to any existing shareholder agreement. If this is so, a shareholder agreement may establish a number of transfer limitations a seller has to follow to be able to make a sale of shares. Failure to abide by those limitations will result in a stock sale agreement being void.

Limitations vary from one shareholder agreement to another and may include one or a few of the following:

- lock-up period: a certain period of time within which a stockholder is restricted from making any sale of their shares;

- permitted transfer: a clause that allows stockholders to transfer or sell their shares only to a permitted number of third parties;

- right of first refusal: a clause that requires stockholders to first offer for sale their shares to other existing stockholders. Only if they refuse to purchase may a seller proceed with assignment to a third party.

Transfer Limitations Under Bylaws

Before entering a stock transfer agreement, a buyer should also read a corporation’s bylaws. From time to time this document may provide additional transfer limitations of shares. Those limitations may include:

- prior transfer’s approval from the board of directors;

- prior transfer’s approval from all or a majority of existing shareholders; or

- any other restrictions.

If a seller violates or fails to follow any rules related to the transfer of shares provided in the bylaws, it may affect the validity of a present stock transfer agreement.

Price and Payment Terms

Every stock transfer agreement template shall define the total purchase price a buyer shall pay for acquisition of stocks. A purchase price is always a market value of stocks to be transferred and differs from the par value price per each share.

The parties to the agreement should also define how and when the purchase price shall be paid:

- in full on the date of signing;

- in full on any other date; or

- in installments according to the specified payment schedule.

A stock transfer agreement lays out the list of acceptable payment methods a buyer can use to complete the purchase—e.g., cash, bank transfer, PayPal, etc.

Parties’ Representations and Warranties

Each party to a stock purchase agreement shall provide another party with a list of certain representations and warranties related to the sale-purchase.

A seller should guarantee to a buyer that:

- stocks are free and clean from any liens and encumbrances;

- seller obtained all necessary approvals and authorizations, if any, established by existing shareholder agreement or a corporation’s bylaws; and

- stocks are not subject to any pending litigation or arbitration procedures.

On the other hand, a buyer undertakes to reassure a seller about the following:

- that a buyer has full authority to enter this agreement;

- that a buyer has been provided with all requested information about the corporation and its financial affairs.

Closing Date

Every sample stock purchase agreement shall define the closing date. A closing date is the date by which a sale-purchase transfer shall be finalized in full.

It basically means that by the closing date a seller shall:

- deliver all applicable stock certificates confirming their ownership of stocks;

- finalize the update of a share ledger;

- issue a new share certificate.

In its turn the buyer shall pay the purchase price in full to a designated seller’s account.

How to customize a legal document template at Faster Draft?

To get a personalized stock assignment agreement, follow a few easy steps below:

- Click the button “Create Document.”

- Answer simple questions in the form.

- Select a document’s format—stock purchase agreement PDF or Word.

- Make a payment.

- E-sign, download, print, and use a customized template in minutes.

Table of content

Frequently Asked Questions (FAQ)

-

1. What is a restricted stock purchase agreement?

Under a restricted stock purchase agreement, a seller transfers restricted stocks into the ownership of a buyer. There are a number of reasons that make this particular document so unique:

- First, a seller under this type of agreement is always a current or former employee of a corporation. This is so because restricted stocks are widely used as an incentive tool for employees across the U.S.

- Second, a restricted stock is a mere promise of a corporation to issue stock units in the future once an employee meets certain conditions.

- Third, at the moment of signing a restricted stock purchase agreement, a seller should be able to meet all the required conditions to own such shares. For instance, if a corporation issues a restricted stock to an employee on condition that he or she will get it upon working at least 3 years with the company, an employee may sell those shares only after the expiration of a 3-year period.

- Finally, before the restricted stocks are vested, an employee does not have any managerial or decision-making rights in a company.

So once the restricted stocks become vested, a seller has a full legal capacity to transfer them as normal common shares to a new buyer.

-

2. What is a common stock purchase agreement?

A corporation may issue two main types of stocks—preferred stocks and common stocks. Under a common stock purchase agreement, a seller transfers their common stocks to a buyer. The difference between those two groups is within the scope of decision-making power vested in each type of stock.

Holding common stocks allows a stockholder to actively participate in a corporation’s management and decision-making process. In other words, they have full and unrestricted voting rights to express their opinion on every matter related to a corporation’s activity.

Common stock shareholders gain more profit once the corporation is doing great. However, when the bad times are coming, common shareholders will be the last in line when it comes to paying dividends or distributing remaining assets in the liquidation process.

-

3. What is the difference between C corp and S corp stock transfer agreements?

The main difference lies within the type of corporation in which stocks are transferred from a seller to a buyer.

Under a C-corp stock transfer agreement, a seller assigns their rights, ownership, and interest in a C-corporation. A C-corporation is a type of separate business entity that has full legal capacity and operates separately from its shareholders. Besides that, a C-corporation’s profits are being taxed twice at two different levels. At first, it is a corporation’s profits, and then it is being taxed as the individual income of each stockholder.

By virtue of an S corp stock transfer agreement, a seller transfers all or part of their stocks in an S corporation. Unlike in the previous case, all the income generated from an S-corporation’s activity and business is passed through to the owners and not being taxed at the corporate level.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates