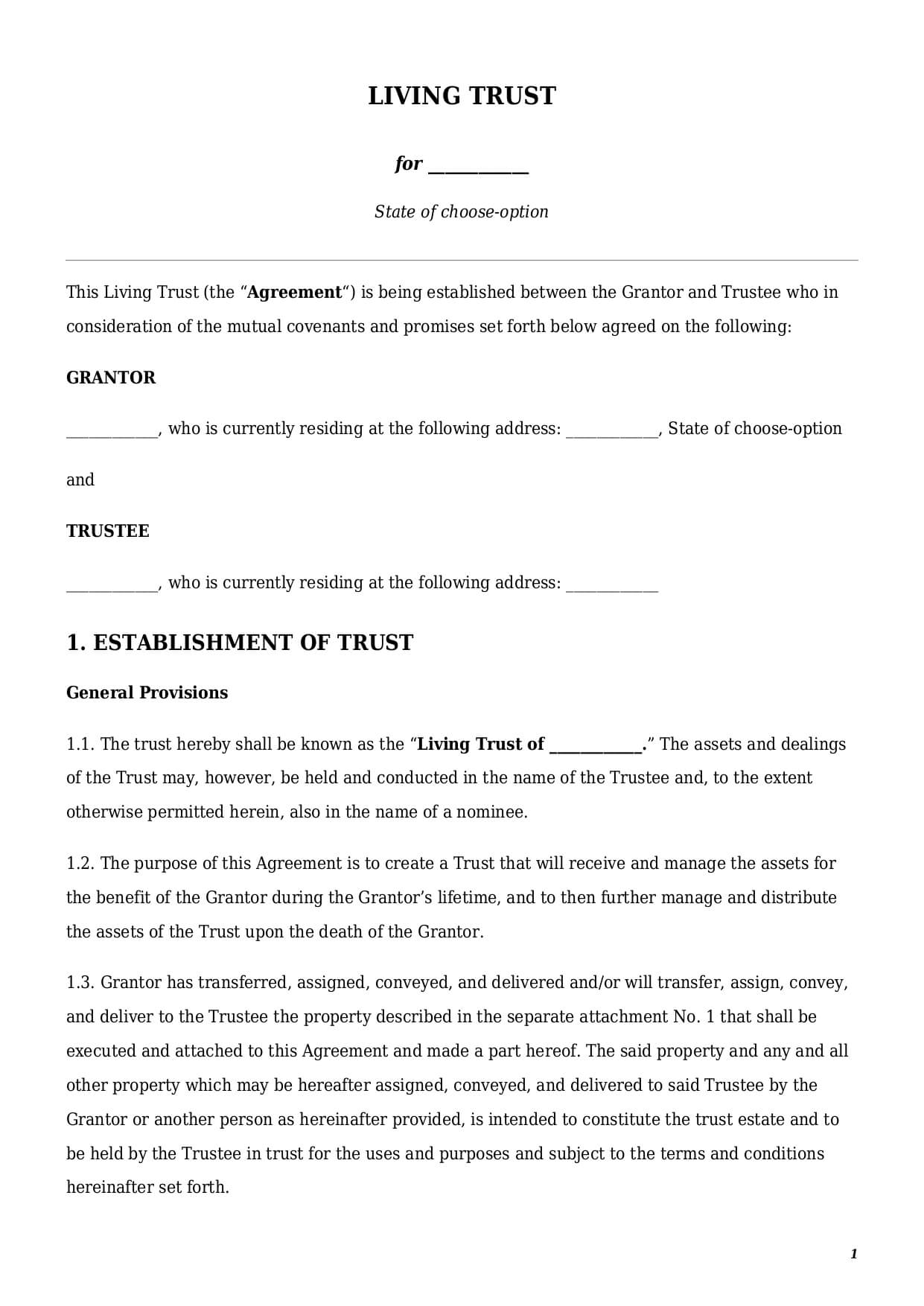

Living Trust Template

Reviews

What is a living trust template?

A living trust template is a binding legal document that creates a trust for managing an individual’s property during their lifetime and distributing it after their death. The present document could be used as an irrevocable or living revocable trust template, depending on the individual’s needs. It is common to refer to the present document as a living will and testament template. However, applying that wording is not legally correct.

The text of a living trust normally includes the following important information:

- details of the parties involved (their addresses, full names, and contact details);

- list of assets that are transferred to the trust;

- instructions for distribution of the income during life;

- distribution of assets after the death;

- trustee powers and duties.

Parties involved in a template for a living trust are:

- Grantor: An individual who establishes a living trust, who is of sound mind, and who shall be at least 18 years of age on the date of making a trust. It is also possible to establish a joint living trust, which is a case for a married couple or a common-law marriage couple.

- Trustee: An individual or organization that acts as a trustee and manages your estate. It could be someone with a professional background or even some of your friends. The law does not impose any specific requirements for the identity of a trustee. On top of that, a trustee and a grantor could be the same person.

There are several types of trusts the grantor may choose from:

Irrevocable living trust template

This is a type of living trust that cannot be changed or amended in the future. It means that even if the grantor wishes to do so, he or she cannot proceed with any change. Irrevocable trust also means that a trust cannot be cancelled or replaced with another document.

A living trust may become irrevocable in two cases only:

- when the text of a living trust template explicitly states its irrevocable nature; or

- when the grantor is dead or incompetent to revoke or change it.

Revocable living trust template

This is a type of living trust that can be changed, amended, or revoked at any time, unless the grantor is incompetent or dead. All living trusts are revocable by default, unless the opposite is stated in the text of a document.

All states in the U.S. allow both types of living trust without any specific limitations.

Last Will vs. Living Trust Template

Both last will and testament and living trust are being used for a person’s estate planning. However, two documents serve different purposes. Below we made a short summary of the differences:

- Effective Date. A last will becomes effective once a testator is dead. Neither of the provisions of the will can become effective when a testator is still alive. A living trust becomes effective on the date of its signing or notarization (depending on the state) and remains effective during a grantor’s lifespan, as well as after the grantor’s death.

- Privacy. A last will is not a private document. The record of it is made in the public register. Contrary to that, a living trust is a private document.

- Probate. Before transferring a property under the will to successors, the property shall undergo probate in the court first. However, this is not the case with a living trust, as the assets are transferred to it right away without probate.

How to draft living trust templates?

Drafting a living trust template requires attention to the details, as well as inclusion of several important clauses. They are the following:

Grantor’s Family Status

The structure and content of a living trust largely depend on the grantor’s family situation—married, in a common marriage, or single. Therefore, the text of a document shall clearly reflect this information.

Apart from that, if a grantor has living children, whether adopted or biological, the full names and dates of birth of those children shall be included in the text of a document.

List of Assets

Every template for a living trust shall define an exact list of assets that are being transferred to a trust. One of the benefits of a trust is that assets are being transferred immediately and do not require any probate, as in the case of a will.

However, different states may have specific requirements on to whom exactly assets shall be transferred. For example, a grantor in a North Carolina living trust template shall sign a separate transfer deed when transferring real estate property into the trust.

Lifetime Payments

Most trusts define frequency and amount of payments a grantor shall receive from a trust during their lifetime. A well-drafted template shall address the following:

- Regular payments: their frequency (monthly, quarterly, or annually) and amount;

- Additional withdrawal: the text of a trust shall define if a grantor may get additional income to regular payments. If so, it is also possible to establish the list of conditions based on which such withdrawal should be allowed.

Distribution of the Residue After Death

Residue is leftovers from a grantor’s estate after paying all taxes, duties, and debts. This is the most essential part of every living trust template.

The most important part of a trust is how the residue (the remainder of assets after debts and expenses) will be distributed. The trust should specify:

- First line of beneficiaries: Those are beneficiaries that receive assets once a grantor is dead.

- Second line of beneficiaries: Those are beneficiaries who can get assets only if neither of the named beneficiaries from the first line has survived.

- Shares of beneficiaries: Beneficiaries may get assets in equal or unequal shares. If this is a second option, the text of a living trust shall explicitly define the amount of each beneficiary’s share.

How to customize a living trust template at Faster Draft?

To get a fully customized legal document template, follow a few easy steps below:

- Click the “Create Document” button.

- Answer simple questions in the form.

- Select a template’s format—living trust template PDF or Word.

- Make a payment.

- E-sign, download, notarize, and use this document instantly.

Table of content

Frequently Asked Questions (FAQ)

-

1. Why is a California living trust template different from other states?

Indeed, there are a number of important considerations that make a California Living Trust Template different from living trusts in other states:

- First, special rules for signing a living trust. In most of the states, having signatures from two witnesses would be enough to make a trust a valid legal document. However, in California a living trust template needs to be notarized further. Without such a notarization, it won’t become an enforceable legal document.

- Second, if a transfer of a real estate property takes place to a living trust in California, such a transfer should be recorded further in the county register.

- Finally, California is a community property state, which means that all the property acquired in a marriage is a couple’s joint property. Therefore, a living trust template California should have two types of listed property in the text: community and individual property.

-

2. What are the specific requirements for a Michigan living trust template?

When drafting a Michigan living trust template, keep in mind the following important considerations:

<ul>

- <

-

-

- em>First, the Michigan living trust shall comply with the provisions of the Michi

gan Tr

-

- ust Code. T

his i

- s a set of mandatory rules and provisions every

-

Michig

-

- an trust sh

ould

- have.

- Second, unlike with California living trusts, Michigan is not a community property state. Thus, the grantor has a full right to dispose of their individual property the way they prefer.

-

3. Shall I use free living trust templates available online?

It is always your decision whether to use or not free templates of legal documents available online. However, we do not recommend doing so for a number of reasons:

- First, in most cases a free legal document template is a document that once was created for a specific situation or circumstance and now is being published online. So when you download a template for free, it may not be suitable for your particular situation.

- Second, unless you are getting a free template from a governmental website, a legal template won’t be 100% free. You would be either required to subscribe for a short free trial period, participate in a short quiz, or do something else in favor.

- Third, a template for a living trust is a life-changing document that deals with your estate once you die or are incompetent. Are you ready to trust all your estate you have been working so hard on and get a generic document for free on the Internet?</li>

- Finally, living trust templates are complex legal documents that need to consider a lot of peculiarities. Thus, customization of such a document is a key for successful estate planning. At Faster Draft we offer such customization online so that you can get a document tailored specifically to your needs and the laws of the state you reside in.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates