Insurance Claim Letter

Reviews

What is an insurance claim letter?

An insurance claim letter is a formal written request submitted to an insurance company to seek compensation for a covered loss, damage, injury, or expense under an active insurance policy. Every insurance claim letter sample serves a dual purpose. First, it acts as an official documentation of a submitted claim, and second, it outlines all the necessary details of the incident and parties involved.

The parties involved in an insurance claim letter sample are a sender and a recipient. A sender is a policyholder who wants to get compensation, while a recipient is a private insurance company.

This letter is suitable for various requests, including:

- medical insurance reimbursement;

- property damage (e.g., home, vehicle);

- car accident claims;

- appeal claims to insurance companies, etc.

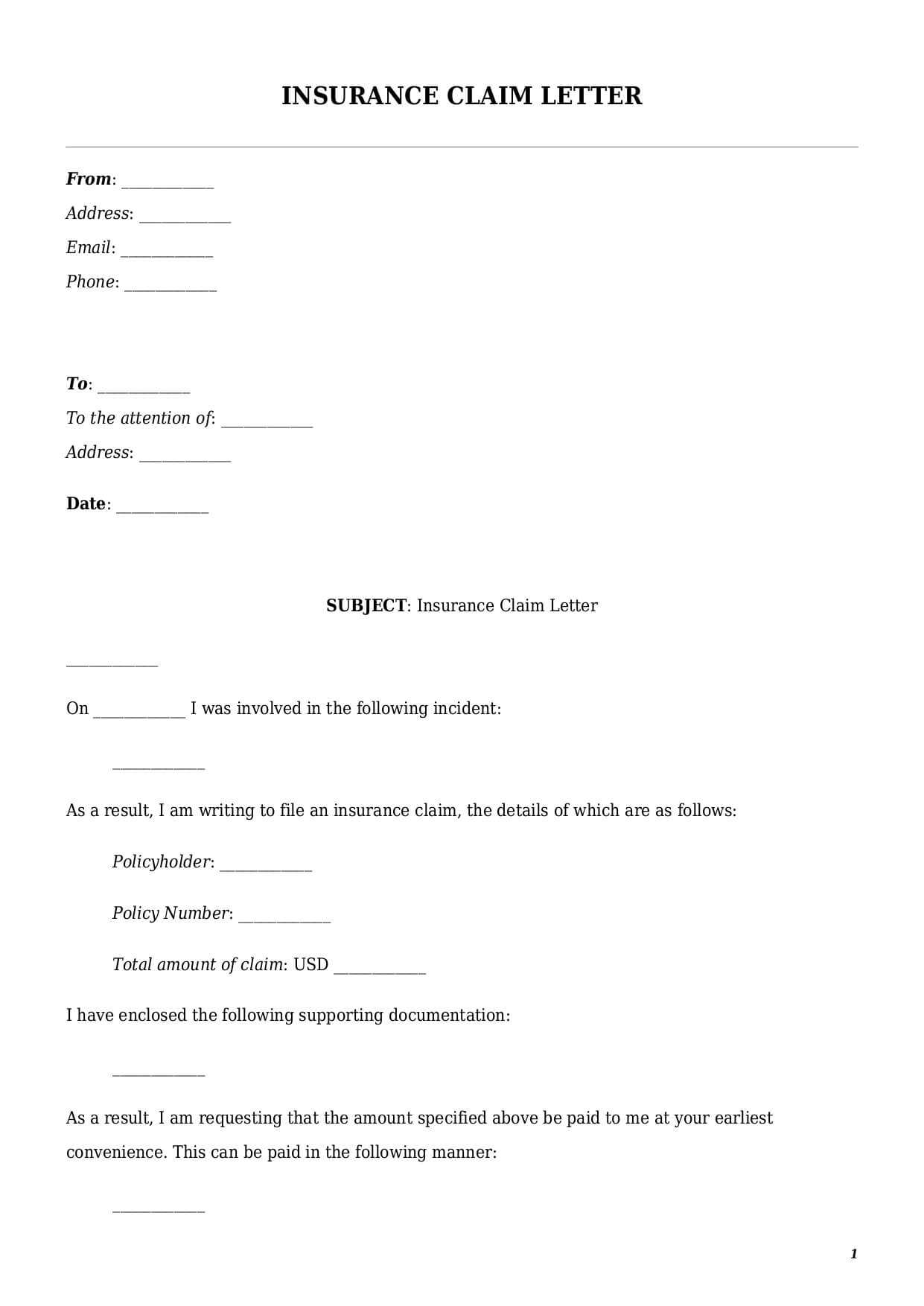

How to draft a sample of insurance claim letter?

A well-structured insurance claim letter sample ensures compliance with compensation procedures, as well as makes an overall request look more professional.

Party Details

Every sample of insurance claim letter must provide details of a letter’s sender and a letter’s recipient. Those details include full name, correspondence address, contact phone number, and email address. If you know an insurance manager who shall consider your case, it is better to address an insurance claim letter directly to their name.

A sender of this letter could be a policyholder or any other third party. It is common to send a sample of insurance claim letter by a representative in case a policyholder:

- is physically unable to make a request due to injuries or treatment;

- is mentally incapable;

- is below 18 years of age; or

- prefers to act through a representative.

Incident Details

The text of a reconsideration letter for insurance claim shall outline as many details of an incident as possible. This should help an insurance company to evaluate the circumstances of your case in a proper way. Make sure to include:

- date or dates on which the incident took place;

- location of an incident (if relevant);

- short description of an incident.

The request’s subject does also influence the letter’s content. For instance, in the case of a medical insurance claim letter, it is also important to name the doctors involved in medical treatments. When it comes to an insurance claim appeal letter, it is always recommended to provide additional details of an incident that were not revealed in the original letter.

Compensation Request

In this part of an insurance claim letter template, an individual must indicate the amount of a requested compensation. It does not necessarily mean that an insurance company shall cover exactly the same amount as indicated in the text of a letter. However, the indicated compensation amount usually plays an orientation role for insurance companies regarding a claimant’s expectations.

Supporting Documents

It is a good practice to support your insurance claim letter with additional documents. For example, in a medical insurance claim letter sample, we recommend attaching medical reports, doctor’s summaries, paid medical bills, etc.

When drafting a property insurance claim denial letter sample, it is better to attach documents certifying the incident, including fire or police reports and inspection statements by state authorities.

There is no approved list of documents, as each insurance claim letter template is unique. However, most of insurance companies have a preliminary list of additional documents that a person shall enclose while sending an insurance claim letter.

Appellation Process

If you are creating a sample letter of appeal for reconsideration of insurance claims, the letter’s content must additionally include:

- reference to the first request letter, including its date and reference number;

- statement of appeal, clarifying the purpose of the letter; and

- reasoning for rejections of the insurance claim (if available).

Document’s Format

Neither federal nor state laws define the exact format an insurance claim letter should have. However, before sending this letter, it is better to check with your insurance company if they have any agreed insurance claim appeal letter format or not. If this is so, in that case it is better to form your request using a standard letter from your insurance company.

How to customize a letter sample at FasterDraft?

To get a fully customized letter template, follow the instructions given below:

- Click the “Create Document” button.

- Answer simple questions in the form.

- Select a template’s format—claim insurance letter sample PDF or Word.

- Make a payment.

- E-sign, download, print, and send out the letter.

Table of content

Frequently Asked Questions (FAQ)

-

1. What is an insurance claim denial letter sample?

An insurance claim denial letter is drafted by an insurance company in cases when compensation is refused. Usually most insurance companies have a standard template they use to notify policyholders about the outcome of internal investigations.

-

2. When should I draft a sample letter of appeal for reconsideration insurance claims?

A reconsideration letter of insurance claim is created when a policyholder receives a refusal for compensation under their original request. A policyholder has an indisputable right to contest such a decision via administrative or legal proceedings.

A sample letter of appeal for reconsideration insurance claims allows a policyholder to request a second review of an insurance claim and its approval.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates