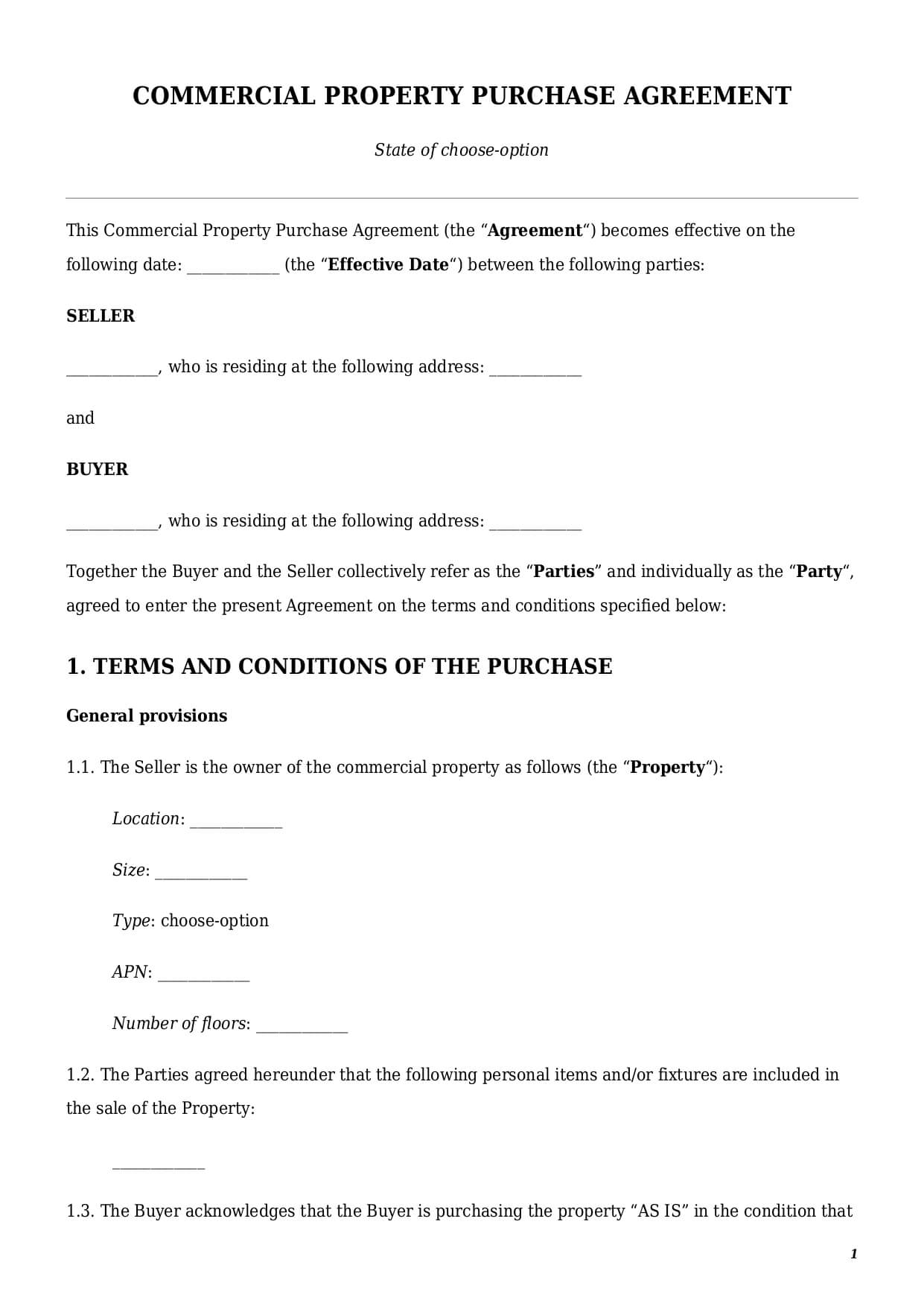

Commercial Property Purchase Agreement

Reviews

What is a property purchase agreement?

A property purchase agreement is a legally binding contract between a buyer and a seller that defines terms and conditions for the sale of commercial property. This template provides a rigid legal framework defining the following essential terms:

- details of the parties;

- description of a commercial property;

- buyer’s financing circumstances;

- payment terms;

- seller’s warranties and disclaimers;

- commercial property’s limitations; and

- closing procedures.

A commercial property sale agreement covers transactions involving the following types of properties:

- office spaces (e.g., office, business center);

- industrial facilities (e.g., warehouse, factory);

- recreational facilities (e.g., hotel, spa);

- shops and restaurants, etc.

The present property purchase agreement should not be confused with an agreement on land purchase. An agreement on land purchase deals with the title transfer over a land plot.

Besides that, both documents follow different due diligence inspection processes for the real estate involved. For example, in a land sale-purchase contract, a buyer shall investigate all property zoning certificates to make sure the land could be used according to the described purpose. Contrary to that, in a sale-purchase agreement of commercial property, a buyer might need to check the country’ local noise regulation prior to opening a nightclub or bar.

All in all, while the sale-purchase of land and other commercial property is of a similar nature, there are a number of legal details that make them two different legal documents.

The parties to a commercial property sale agreement are the seller and the buyer. Both parties could be individuals or legal entities willing to sell or to purchase a commercial property. The acquisition of commercial property in the United States is open to foreign companies and individuals. Therefore, a buyer or a seller could be a non-US citizen or an overseas company.

How to create a commercial property purchase agreement template?

Creating a legally valid and enforceable commercial property purchase agreement template might be a daunting task. While neither federal nor state laws define the exact contract’s content, there are a few critical components every property purchase agreement should have.

Details of the Parties

The agreement must clearly identify the identities of a buyer and a seller. This information includes their full legal names, addresses, and contact information. If a legal representative signs a contract on either party’s behalf, the full legal name of such a representative should also be stated.

All the information about the parties should be accurate and not contain any mistakes.

Description of the Property

The purchase agreement for commercial property should include a full description of a commercial property:

- legal address and precise location;

- type of property (e.g., bar, office, factory, warehouse);

- total square footage;

- APN number (i.e., a number of a land plot where a property is located);

- number of floors;

- year of establishment;

- any permanent fixtures attached to the property (e.g., installed aircon system).

For any property within the USA that was built before 1978, a purchase agreement for commercial property should contain an additional lead paint disclaimer. This is an official disclosure of the seller that a property may contain lead-based paint, which is a hazardous material specifically harmful for children and pregnant women. By signing this agreement, the buyer acknowledges such a disclosure.

Last but not least. The seller should inform about all possible defects (hidden or visible) a property has. The list of such defects (if any) should be incorporated directly in the text of the agreement.

Property Limitations

Every commercial property purchase and sale agreement should address all existing rights, obligations, or limitations tied to the property. The limitations tied to the commercial property might be the following:

- existing tenancy or occupancy rights

If there is an existing lease agreement for a commercial property to be sold, the new buyer automatically becomes the landlord under the said lease contract.

- municipal liens

It might also be the case that the commercial property has a number of unpaid municipal fees (e.g., trash collection, community cleaning fees, electricity charges). Failure to settle all those fees prior to the closing date may result in a transaction being void. Therefore, it is crucial for both parties to ensure that all the municipal liens are duly settled prior to closing a commercial property purchase and sale agreement.

- property’s easements

A commercial property may also be subject to additional easements (e.g., shared driveway easement or parking easement). In this particular case such an easement is attached to the property and thus is automatically transferred to the new buyer.

Prior Inspection of the Property

Prior to entering into a purchase agreement for commercial property, a buyer may wish to inspect the property. This is a usual business practice that is frequently used by the buyers and sellers to:

- identify the existing defects of a property;

- make internal or external code compliance checks; and

- perform environmental assessment of a property (e.g., underground tanks).

Upon the performance of such an inspection, the buyer may request the seller to fix the identified issues. If the seller fails to fix the issues within the period of time agreed upon by the parties, the buyer has the unilateral right to terminate the contract.

A strong purchase agreement for commercial property shall also provide a full refund of any deposit back to the buyer if serious property defects are discovered.

Payment Terms

A commercial property purchase agreement should include in detail all the payment terms:

- total purchase price;

- deposit amount and date of its payment;

- repayment schedule for the remaining balance;

- acceptable payment methods.

On top of that, the parties should also address in the text of a contract how the division of unpaid taxes, insurance payments, or utility bills should be made. As a rule of thumb, the seller is responsible for the payment of their portion of utilities and taxes prior to the closing date.

Closing the Deal

The closing process is the final step for every commercial property purchase agreement. Usually it takes place after all the inspections and due diligence of a property are finalized.

The key elements related to the closing should be the following:

- Closing date

- Closing address/location

- Parties responsible for specific closing costs

- Required documents (e.g., deed, title insurance, certificates of occupancy)

- Conditions for transfer of keys, codes, or access rights

- Recording of the deed and change of ownership

Depending on each particular case, the parties may also consider the inclusion of other additional post-closing obligations. For instance, if there is an existing lease agreement, the buyer may wish to be introduced to the tenants.

How to customize a property purchase agreement at Faster Draft?

To get a personalized document’s template, follow a few easy steps below:

- Click the button “Create Document.”

- Answer simple questions.

- Select a document’s format—Commercial property purchase agreement PDF or Word.

- Make a payment.

- Download a customized template.

This template can be customized to reflect distinctive features of any type of commercial property, used financing options, existing property’s limitations, etc.

Table of content

Frequently Asked Questions (FAQ)

-

1. What is the difference between a property purchase agreement and a commercial lease agreement?

In a commercial property purchase agreement, a seller transfers full and marketable title over real estate to the buyer, and the buyer undertakes to pay a purchase price.

Under a commercial lease agreement, a property’s owner provides a temporary right of usage and possession of a property to a tenant, and a tenant undertakes to perform regular lease payments. A commercial lease agreement does not change the ownership of a real estate object.

-

2. What does commercial purchase mean?

A commercial purchase is a legal transaction between the seller who wishes to sell a property and the buyer who wishes to acquire that property.

A seller transfers their full legal title over a commercial property to a buyer in exchange for specific remuneration.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates