Business Purchase Agreement

Reviews

What is a business purchase agreement?

A business sale agreement is a legal document that defines the terms and conditions of transferring ownership of a business from one party to another. A business sale agreement contract defines in detail the process of transfer of business ownership and assets. It helps to set up mutual rights and obligations of the parties involved.

A business sale agreement can also be referred to as an agreement of purchase and sale of business.

A business sales agreement contract can be used for buying or selling a business of different types. Those types include sole proprietorship, partnership, limited liability company (LLC), and corporations.

The business sale agreement covers essential details of a business’s transfer:

- Description of the business to be sold;

- Description of any asset(s) involved;

- Terms of payment (e.g., amount of the purchase price or regular installments);

- Parties’ representations and warranties (e.g., guarantee of a business’s goodwill);

- Closing date; and

- Other important clauses depending on a business’s type.

The parties to a business sale agreement are buyer and seller. They can be either individuals or companies. If there are several owners, all of them will be the parties to the business sales agreement contract.

When to Use a Business Purchase Agreement?

A business sale agreement is typically used for buying and selling the business in the United States.

Why Is it Important to Use a Business Purchase Agreement?

There is no federal or state law that obliges you to use a business sale contract template to sell or buy a business. Most people may think that having a business sale agreement is only for big corporations.

Even selling a small company should be considered carefully. It helps to avoid possible unpleasant legal consequences in the future.

Having a legally binding document

Once parties sign a business sale agreement form, it becomes binding for both parties. Both buyer and seller will have mutual rights and obligations towards each other. Even if either of the parties wants to exit the deal, they would need to compensate the other party.

For instance, Sarah agreed to buy the business that belongs to John. Parties enter into a business sales agreement contract. After signing, John declines offers from other potential buyers. A few weeks later, Sarah refuses to continue, as she changed her mind. She says to John that since no preparations have been done yet, it is not a big deal. John recalls that the signed contract obliges Sarah to pay default fees for not closing the deal.

Clarity of terms and conditions of sale

Having a written legal document sets up a framework for the sale-purchase agreement. All tiny details are being defined to avoid ambiguity. A written business sale agreement helps to set up clear expectations for both parties.

For example, Marta wants to buy Jemma’s small chain of beauty salons. Jemma is excited about this offer, as she wants to retire soon. Jemma also needs cash quickly. Parties start discussing a business sale agreement template. During the discussion, Jemma realizes that Marta does not have cash. Marta plans to apply for a loan soon. As applying for a loan may result in long months of waiting, Jemma does not want to proceed further.

Defining the timeline

The purchase of the business is a complicated and long-lasting process. A company purchase agreement divides the whole process into separate milestones:

- Due diligence of assets (both tangible and intangible) and finance;

- Transfer of ownership of assets (e.g., real estate, trademarks);

- Making payments (e.g., pay-off of all debts, tax liabilities, purchase price of business);

- Closing date.

Once both parties understand the sequence of all stages, it helps to avoid disputes along the road.

For instance, John and Peter signed a business sale agreement last month. According to it, John purchases a small pizza restaurant in a city’s downtown. The purchase price for the business should be paid to Peter on a closing date. Soon Peter changes his mind. He demands the whole payment now and does not want to wait till the closing date. John reminds Peter that the full payment should be made before the closing date. The same as stated in the earlier signed business sale agreement contract.

What are the different types of business sale agreement contracts?

Transfer of ownership over a company can be done in either of two ways:

- Transfer of assets; or

- Transfer of company’s shares.

The exact type of transfer depends on the complexity of the business’s operations as well as the size of the business.

Transfer of Assets

Transfer of a sole proprietorship, partnership, or LLC is usually performed via transfer of assets.

A business may have a variety of assets, including real estate, stationery, equipment, and trademarks. In that case a business purchase and sale agreement states that ownership of those assets should be transferred from a buyer to a seller.

If it is real estate or IP rights, the transfer of ownership should be further registered by a notary to make it valid.

Transfer of Company’s Shares

A business purchase contract for corporations is made through a sale-purchase of a company’s shares. In that case a business sale agreement should transfer 100 % of shares in a company. This is the way to make sure that the new buyer has full control over a company.

This type of business sale transaction would be suitable for both C corporations and S corporations.

What to Do Before Writing a Business Sale Agreement Contract?

There are a number of prerequisites a buyer and seller should be aware of before entering a business purchase agreement.

Sending a Letter of Intent

A good practice to start any negotiations about the sale-purchase of a business is to send a letter of intent. A letter of intent is a simple legal document. It defines main conditions of transaction like purchase price, payment terms, and timeline. A letter of intent makes the negotiation process easier.

As a rule of thumb, a letter of intent is further incorporated in the business purchase contract.

For instance, Jack owns two dental clinics in his hometown. He plans to retire soon and have no one to transfer his business to. He does not want to close the business either. One day he receives an offer from James to sell his business. James is an owner of a chain of dental clinics in a neighborhood town. Both parties are eager to discuss possible collaboration and solutions together.

Valuation of Assets

If you are planning to start any negotiations, knowing the price is key. How to determine the purchase price for a business in the right way?

You have to check the assets a business currently has, their market price, and their condition. Also verify financial statements of a business, if publicly available, for more details.

The science of business acquisitions is to offer a good price. It helps to break the ice and start the negotiation process.

For example, Mark wants to enter a sale-purchase agreement to get a chain of pizza restaurants. A chain consists of 10 restaurants and expensive equipment. Because of the good location, the average price for commercial leases is extra high. Mark sends an offer, which exceeds the business’s estimated value by 2 times. Jack, the owner of a pizza chain, is eager to discuss it further.

Check Pending Disputes and Litigations

When a person enters agreement to buy a business, checking the list of existing litigation procedures is a must. Even if you know that a business has a good reputation and lots of happy clients, do not hesitate to double-check.

A business may have litigation at a federal or state level, or both. Thus, both levels should be checked diligently.

Information about litigation at the federal level can be found in the PACER database. For a state level, you would need to locate a website with judicial records for that specific state. For instance, the beauty salon “Venus” is registered in Wyoming. In that case you would need to access the website of the Wyoming Judicial Branch.

Do not hesitate to approach business owners to get more information about ongoing mediation. For instance, imagine a situation where a company is also involved in a mediation process with their former employee. If a mediation process does not give any result, either of the parties can go to the court. The price of a dispute is high and may have a potential financial threat in the future.

Check for Third Parties’ Rights

Another important thing for business acquisitions is to check third parties’ rights. Third parties’ rights may include:

- Loans and mortgages. A good business sale agreement sample should list all existing debts a business has. For instance, John purchased a small dental clinic a year ago. He rushed and did not check financial statements carefully. Yesterday he received a notice from a bank to pay back a loan, which was used to buy premises for a dental clinic. John is surprised, as he thought that there were no debts.

- Encumbrances and leases. Even if a business is free of financial debts, it does not mean there are no other limitations. Check ahead if any of a business’s assets have contractual or legal encumbrances. For instance, Mark purchased a farm producing oranges. A few months afterwards, he noticed that some vehicles passed all the time through the part of his land. Later on, Mark finds out that another farmer has a free leasehold to bypass the land. A business purchase agreement contract does not contain any information about that. If Mark had checked it, he would not have entered the transaction.

- Corporate limitations. If a purchase and sale of business takes place via transfer of shares, check bylaws and shareholder agreements. In most of the cases, those documents may contain certain corporate limitations. Among them are pre-emption rights or freezing periods for transferring shares. If this is so, your business purchase agreement contract should be compliant with them. For example, Jessica purchases 80 % of shares in a corporation from Sarah. Sarah has a majority of votes and can adopt any decision in a company. Later on, Jessica becomes a party to a litigation. It turns out that Sarah sold her shares during the freezing period. The said freezing period has been established by an existing shareholder agreement. Minor shareholders started a lawsuit against Sarah and Jessica.

Check for a Business Reputation

If you are about to enter a purchase agreement for business, check a business’s reputation. Whether their clients are happy? Does the business have positive reviews on Google or social media?

Can you locate any news articles saying anything about that business?

Make your own investigation to make sure you do not miss any pitfalls.

Which Things to Include in a Business Purchase Agreement?

If drafting a business purchase contract template for the first time, make sure to include the following elements:

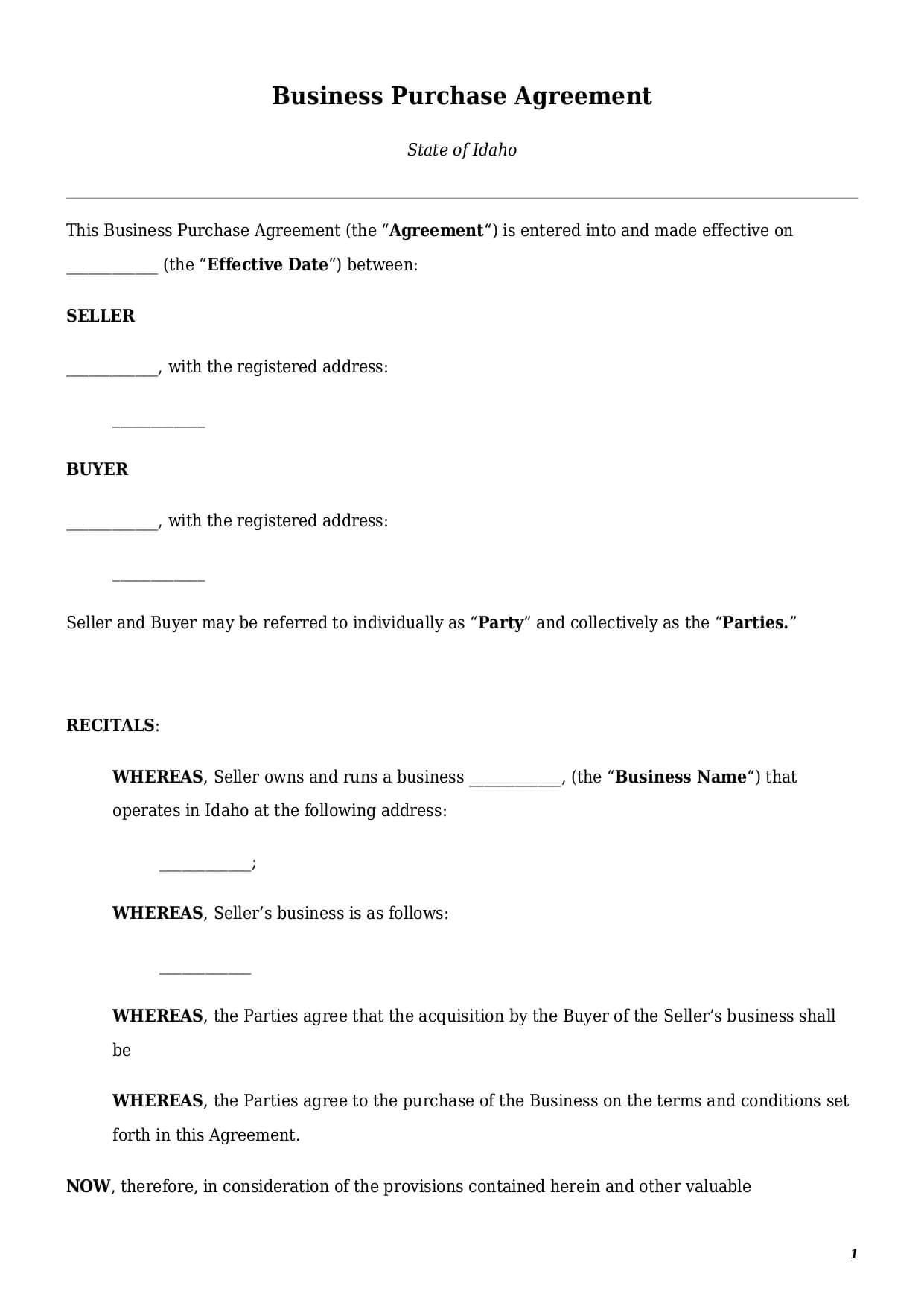

Parties Details

Include full names, addresses, and contact information in an agreement of sale template. If you are a buyer, make sure that you enter a business sale agreement with a real owner.

If a purchase of a business happens through a transfer of assets, an owner should be a legal owner of those assets. If it is real estate, their name should be indicated on a deed or act of conveyance.

If a purchase of a business happens via transfer of shares, an owner should be a company’s shareholder. In that case, their name should be indicated in the certificate of the company’s formation.

Description of Business

A company purchase agreement template should contain a detailed description of a business. The following information needs to be listed here:

- List of contractors, business partners, and customers;

- Detailed description of business operations;

- List of all assets and their valuation (e.g., equipment, vehicles, real estate, etc.);

- List of employees.

Terms and Conditions of Sale

A business sale agreement should define the amount of a purchase price and how it should be paid. There are lots of payment options:

- Paying the whole amount as a lump sum on a specific date;

- Paying in regular installments (monthly, quarterly, or annual);

- Other variations.

Parties also need to discuss the payment method they prefer to use, like cash, check, or wire transfer.

If a buyer plans to get a loan to repay a purchase price, this should also be stated in a sale-purchase agreement. It is advisable to include a bank’s default clause as well. A bank’s default clause means a bank’s refusal to grant a loan to a buyer. In that case a buyer will be released from a responsibility for not being able to close the deal. The parties may also agree on a specific deadline by which a loan should be obtained by a buyer.

Last but not least. The closing date is a date on which the transfer of a business should be finalized. By that date all the payments should be made and all titles should be transferred. A closing date might be changed later if both parties agree to do so.

Transfer of Ownership

If a business is sold via a transfer of assets, think of a bill of sale in advance. A bill of sale is a document that proves a transfer of ownership over certain movable assets. The movable assets may include equipment, stationery, cars, etc.

For a title’s transfer over real estate, having a business bill of sale is not enough. A buyer would need to register their right further with a notary and a public registry. The same thing should be done with regard to patents and trademarks.

If a business is sold via a transfer of shares, a share transfer agreement should also be signed.

Confidentiality Clause

A good sample purchase agreement for business always has a confidentiality clause. It means that both parties should keep the transaction a secret. Most parties prefer to wait until the closing date. While others may agree on earlier disclosure. In some cases, making certain information public may negatively affect business acquisitions.

A confidentiality clause may also prevent a seller from disclosing certain sensitive information. It could be a secret production process, know-how, or other confidential information. Disclosure of such information may lead to damages. Usually a confidentiality clause lasts between one and three years.

Non-compete Clause

A buyer may wish to include a non-compete clause within a business sale agreement. A non-compete clause protects a business against competition from its former owners. A seller may create a similar business to the one he owned. A seller may also solicit clients or contractors who work within a sold business.

A business sales agreement contract should define the duration of the non-compete obligation. A normal duration would be between 6 months and 2 years. The exact duration usually depends on the industry.

Employees and Workers

If a business you plan to purchase has employees, it should also be addressed in a purchase of business agreement. Parties have to define if a new owner wishes to keep all employees or some of them, or a layoff should be planned ahead.

In case of termination of employment relations, all employees should be notified.

If there is a trade union, a buyer has to make sure that all consultations are conducted with it in advance.

Miscellaneous

Depending on a sale-purchase agreement template, parties may wish to include other provisions. The most important thing is to insert representations and warranties. Those are parties’ guarantees about certain facts or circumstances. For instance, a buyer may guarantee that a business is free of any debt. If any former debt arises in the future, a buyer would have a right to request its full coverage from a seller.

A buyer and seller may also include a dispute resolution clause. It may help to resolve potential disputes in the future more effectively. For instance, parties may wish to pick up a specific court that will solve a dispute. Or they can appoint a mediator to resolve a dispute amicably.

Business Sale Agreement Checklist

Ready to jump into a business acquisition process? Use our free checklist below:

Pre-Sale Stage

Check accounting statements of a business you plan to purchase. Make sure you have all the information you need, including information about any debts.

Consult with your lawyer and accountant about the tax implications of a business purchase.

Consider any potential implications of a change in a business ownership’s.

Investigate any ongoing or potential litigation and disputes, as well as assess their risks.

Discussion Stage

- Check if there is a need to sign non-compete or NDA agreements;

- Make the complete list of all assets the business has (tangible and non-tangible);

- Make the complete list of all rights the business has (e.g., commercial lease, encumbrances, etc.).

- Make the complete list of all IP rights (e.g., trademark, domain name, website, social media, etc.).

- Make the complete list of all employees and workers who are employed with the business;

- Make the complete list of all contractors, clients, and customers;

- Discuss how the purchase price should be paid (e.g., terms of payment, method of payment, loan, etc.).

Contract Signing Stage

- Consult your attorney about the terms of a business sale agreement contract.

- Discuss additional conditions (e.g., purchase of stocks, public announcement, etc.).

Post-Contractual Stage

- For a buyer: follow the payment schedule.

- For a seller: arrange all necessary transfers of ownership.

- For both: follow up regularly with your counterparty. Inform them about any progress you have and any obstacles you may face.

Get Your Business Purchase and Sale Agreement Template

To get your business sale agreement done, remember a few simple tips:

- No Mandatory Format. You can have any business sale agreement format you wish. Neither federal nor state legislation imposes any specific format. Though, make sure that it contains all essential elements.

- Using a Sample. If you are using a business sale contract sample from the Internet, make sure to read it twice. A sample may not reflect an agreed arrangement between a buyer and seller. Therefore, double-check it with your attorney before signing.

- Signing a Business Sale Contract. A business purchase agreement template becomes valid only if signed by both parties. There is no requirement for notarization or witnessing. Parties may do so, however, to add an additional layer of protection.

- Signing Additional Documents. If you transfer movable assets like equipment or vehicles, a buyer and seller have to sign a bill of sale. You can use a simple business bill of sale template to reflect the transfer of ownership. If you transfer real estate, a deed of sale of real estate should be signed as well.

Table of content

Frequently Asked Questions (FAQ)

-

1. What does the acronym APA stand for in a purchase agreement?

APA is an abbreviation for asset purchase agreement. This is a type of legal contract used as part of a business sale-purchase transaction. If a business purchase takes the form of an asset’s transfer, signing an APA is essential. APA is also known as a business bill of sale. By virtue of the APA, the seller can transfer ownership over various business assets.

-

2. Should I use for buying a business contract template?

There is no legal requirement for having a written business sale contract. But, as a rule of thumb, most businesses use it for a number of reasons. It helps to define clear terms, avoid ambiguity, and set up realistic expectations.

-

3. How to get a business purchase agreement sample?

You can create a fully customized template of a business sale agreement at Faster Draft. You have to answer a few questions in the questionnaire. It takes only a few minutes. Afterward, you will receive your customized sample purchase agreement for business via email.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates