Loan Agreement

Reviews

What is a loan agreement?

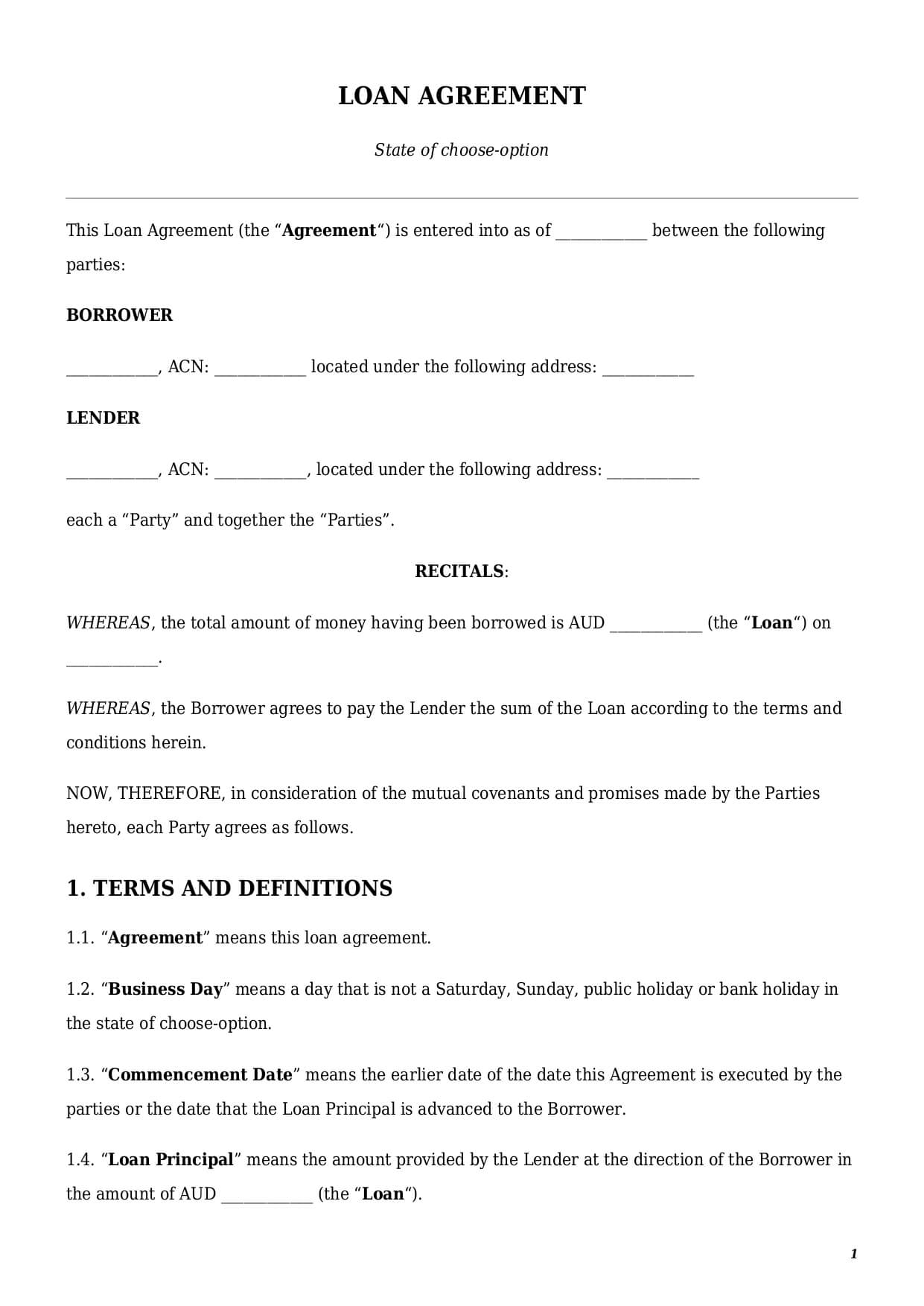

A loan agreement is a binding legal document between two or several persons by virtue of which one party borrows from another a defined sum of money. This loan contract template Australia helps you to establish a solid legal framework for borrowing and lending money between individuals, companies, and businesses. This template helps to clarify parties’ mutual rights and obligations and the loan amount and repayment schedule in a clear and compliant way.

The present template defines the following key elements:

- full identification details of a borrower and a lender;

- type of loan (multipurpose or one-purpose only);

- security and collateral (if applicable);

- loan amount;

- interest (if applicable);

- repayment schedule; and

- applicable law.

The parties involved in a contract of loan are a borrower and a lender. Both parties could be represented by an individual, company, or organization operating in Australian territory. Depending on each individual case, a loan contract template could have one borrower and several lenders, or several lenders and one borrower, or both.

A lender is a person that gives you a certain amount of money (i.e., a loan) for a defined period of time. You do not need any special license or authorization to give a loan to your family member, friend, or business partner. However, if you provide loans on a regular basis as a part of your business activity, in that case Australian regulations require you to first obtain a respective financial license. A borrower is an individual or a legal entity who needs money and borrows it from a lender.

When Do You Need a Loan Agreement in Australia?

Indeed, a loan agreement document template is one of the most frequently used legal documents in Australia. Using this template is suitable when:

- borrowing money between family members;

- giving a loan to your business partner;

- helping you, friend, with some extra cash;

- borrowing money between shareholders and a company;

- soliciting additional capital to scale your business; or

- formalizing any existing lender-borrower relations.

What shall a simple loan agreement Australia include?

Drafting a loan agreement Australia template is not an easy task, as it requires attention to the details as well as inclusion of all important provisions. A comprehensive Australian contract of loan must always include five main pillars. They are party details, loan details, security or collateral, event of default, and applicable la. We will examine each of those pillars below in the present section.

Party Details

Every money loan agreement template should start with the parties’ details. As a rule of thumb, those details include the full name, business address, and contact details of a borrower and a lender.

However, it is also possible that the text of a contract includes a guarantor. This is an additional third party to a loan agreement template who guarantees the repayment of the principal loan amount by a borrower. Usually, if a borrower fails to pay the principal amount or part of it on the agreed date, a lender may seek repayment from a guarantor instead. A guarantor could be any individual or company who wishes to secure a borrower’s obligations under the present loan contract template.

Once the document is finalized, all the parties involved must sign it. It does not matter if you sign the document using online e-signature tools or by hand. You can use the FasterDraft online e-signature tool to sign a loan contract template Word in PDF online.

Loan Details

Every personal loan agreement contract template must clearly outline details of the loan, including:

- Principal amount and the currency (e.g., AUD 100,000).

- Repayment date or repayment schedule. Parties must establish a clear deadline by which the loan shall be repaid in full. For example, a loan agreement sample can prescribe the repayment in full on the 14th of May or 10% of the principal amount each month.

- Interest Rate. A lender could establish an interest rate for using borrower money. The amount of the interest rate is not set by Australian laws. Therefore, parties are free to choose any rate they prefer to. The most common option for interest rate in a simple loan agreement Australia is between 1 and 3% annually.

- Purpose. Usually a personal loan contract template could include a purpose for which the borrower’s money should be used. If the clear purpose is stated in the contract, in that case a borrower cannot use the obtained loan for a purpose other than that provided in the text of the original contract. Inclusion of a loan purpose is an optional clause.

Security and Collateral

The repayment of the loan amount under the loan agreement contract template could be backed up by a collateral. This is when a borrower provides their interest in a certain type of property (e.g., a car, stocks, or real estate) to support the obligation of the loan return in the future.

If there is a default event and a borrower cannot repay on time, a lender could use a borrower’s collateral to compensate for default payments.

Event of Default

All business and personal loan contract templates in Australia shall include a separate clause defining the list of events of default. Those are circumstances that may occur in the future, upon the occurrence of which a lender gets an immediate right to the contract’s termination and request of the full repayment. If there is a security or collateral in place, a lender can go after a security to compensate their financial loss after the contract.

Usually an Australian loan agreement template includes the following default events:

- borrower’s bankruptcy or insolvency;

- failure to use a loan according to the agreement purpose (applicable only for one-purpose loans); or

- failure to pay any amount by the due date.

Applicable Law

Every Australian loan contract document shall include a reference to the applicable law. This is the law of a state that shall apply to the document, and in compliance with which such a document shall be drafted.

At FasterDraft you can customize the loan contract template for all 6 states, including:

- New South Wales;

- Queensland;

- South Australia;

- Western Australia;

- Tasmania.

For instance, a loan agreement template NSW means that the law of the state of New South Wales automatically shall apply to the interpretation, execution, and termination of the present agreement. In case of a dispute, the courts located in the state of New South Wales shall have the exclusive jurisdiction over the dispute.

How to customize this money loan agreement form at FasterDraft?

To get a fully customized loan agreement template, follow a few easy steps below:

- Click the “Create Document” button.

- Answer simple questions in the form.

- Select a template’s format—loan agreement template Australia PDF or Word.

- Make a payment.

- E-sign, download, print, and use this document.

Table of content

Frequently Asked Questions (FAQ)

-

1. Do family and friend loans need a written agreement in Australia?

Yes, even when it is a personal loan agreement contract, both parties must make it in writing. Having a solid written legal document guarantees clarity of repayment terms and clarifies mutual parties and obligations.

-

2. Do both parties need to sign the loan agreement?

Yes, both parties must sign this loan contract document to make it enforceable. In simple words, putting signatures “activates” the legal power of a document. Once the document is signed, parties are obliged by its provisions. It also means that in case of a dispute either party can bring the case to a court, and a court shall consider the present document as legal evidence and proof.

-

3. Can this loan agreement be amended after signing?

A good personal loan agreement example must always include an amendment clause. To amend even a simple loan agreement, both parties must introduce those changes in writing and sign them. It is not possible to change or amend the document by one party only. Mutual consent of both parties is mandatory.

Parties to a loan agreement template could amend this contract an unlimited number of times.

-

4. What are the main types of a money loan contract template?

This money loan contract template could be classified in a different way.

Based on who the parties to this agreement are, there are:

- loan contracts between businesses;

- loan contracts between businesses and individuals; and

- loan contract between family members.

Based on how a borrower’s obligations are secured:

- secured loan (when there is an appointed guarantor or collateral in place); or

- non-secured loan.