Single Member LLC Operating Agreement

Reviews

What Is an Operating Agreement for Single-Member LLC?

An operating agreement for a single-member LLC is a legally binding internal document that outlines the structure, rules, and operational procedures of a limited liability company with only one member. While for most of the states within the U.S., this agreement remains a non-mandatory document, there are a number of reasons why every business must have it:

- First, it clarifies responsibilities between a single member, manager, and officers.

- Second, it sets up a clear separation between the owner and the business.

- Third, it defines the rules for disposition of the LLC’s assets and property.

- Finally, it brings overall clarity in the LLC’s daily management and operations.

This single-member LLC operating agreement will be suitable for an LLC with a single member only. For an LLC with several members, a multimember LLC operating agreement should be used instead.

The party to a single-member operating agreement is an individual or legal entity that holds 100% of LLC membership interest. Therefore, this template has a less complex structure compared with an LLC with several members. In particular, it does not deal with voting rights, classes of membership, or withdrawal from the LLC, as well as additional rules on a membership transfer.

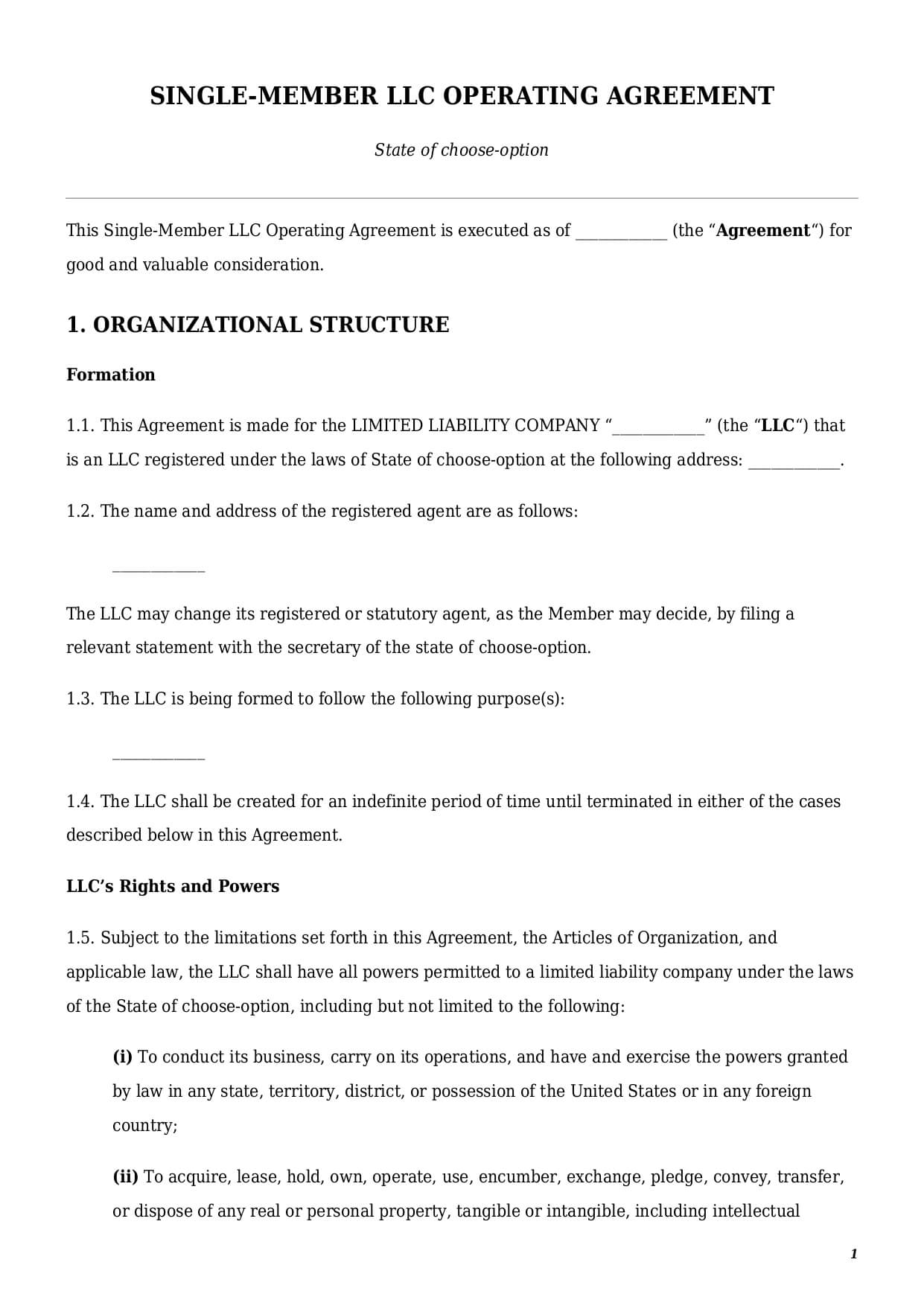

How to draft a single-member LLC operating agreement template?

Creating a single-member LLC operating agreement template is a challenging task even for lawyers. Despite a document’s apparent simplicity, there are a number of important considerations every founder shall consider first. Below we prepared a list of mandatory elements every solid LLC agreement should have:

LLC’s Registration Details

A sample operating agreement for single member LLC defines the full LLC’s registration details, including:

- full name, date of registration, and business address;

- purpose of business;

- full name, address, and contact details of a registered agent;

- LLC’s state and date of registration.

Member’s Contribution

A must-have for every sample single-member LLC operating agreement is information about a founder’s contribution. A capital contribution may have various forms, including money, goods, services, property, etc. If a member provides a capital contribution in a form other than money, then the text of an operating agreement should provide a contribution’s value in USD.

The text of an operating agreement shall also include a disclaimer about the provision of any contributions other than capital. In that case, all those contributions shall be treated as an LLC’s debt and shall be returned back to a single member with applicable interest.

Management of the LLC

An LLC single-member operating agreement lays out rules for an LLC’s daily management. The LLC could be managed in either of two ways:

- by a single member; or

- by a specifically designated manager.

When a single member performs the LLC’s management, each of their actions on behalf of the LLC becomes binding for an LLC. However, this may not be the case for an LLC managed by an appointed manager. For a manager-managed LLC, a single member may include the following limitations:

- First, an appointed manager may not have signing authority for all or specific types of contracts.

- Second, an appointed manager might be able to enter a contract with a total value below a certain threshold.

- Third, an appointed manager may have a limited number of duties (e.g., can hire employees but cannot fire them).

Dissolution of the LLC

A typical single-member LLC operating agreement example shall address the process of the LLC’s dissolution, including:

- valuation of LLC’s assets;

- satisfying creditors’ requests;

- order for distribution of remaining assets, etc.

A single member may adopt a decision to liquidate an LLC at any time. In a limited number of cases the applicable federal or state laws may require a single member to dissolve the LLC, including:

- bankruptcy;

- court order;

- sale of business when there is no remaining member left in the LLC;

- expiration of a period for which the LLC was registered, etc.

Liability and Legal Protections

A critical reason for having an operating agreement single-member LLC is to separate a single member’s liability from an LLC’s liability. Therefore, the text of an operating agreement should incorporate the mandatory principles below:

- A single member shall not be personally liable for the debts and obligations of the LLC.

- An LLC is a legal entity separate from its member.

- A single member remains responsible for the LLC’s liabilities to the extent of the initial capital contribution.

- A member or manager cannot be liable for acts done in good faith on behalf of the LLC.

Those principles are particularly vital for protecting a single member’s personal assets and property against potential claims from the LLC’s creditors.

How to customize a document template at Faster Draft?

To get a fully personalized legal document template, follow a few easy steps below:

- Click the button “Create Document.”

- Answer simple questions in the form.

- Select a document’s format—single-member operating agreement PDF or Word.

- Make a payment.

- E-sign, download, and use a ready-made customized template in minutes.

Table of content

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates