Shareholder Agreement

Reviews

What is the shareholder agreement?

A shareholder agreement is a legally binding contract among the shareholders designed to govern their relationship, resolve disputes, and regulate the ownership and transfer of shares.

This document is not mandatory by nature and is used to complement the company’s constitutional documents, such as articles of incorporation or articles of organization.

In its essence, a shareholder agreement template lays out precise terms and conditions for relations between shareholders, including:

- rules for transfer of shares and applicable limitations;

- establishment of corporate limits for the board of directors;

- non-compete and confidentiality obligations of shareholders;

- process of appointment of officers;

- withdrawal from a company;

- a company’s voluntary dissolution; and

- dispute resolution between shareholders.

The shareholder agreement template acts as a rigid legal framework, ensuring consistency and compliance.

The parties involved in a shareholder agreement are shareholders of the company and the company itself. A shareholder is an individual, business, or legal entity who is:

- a current shareholder of a company; or

- an investor who is willing to acquire shares in such a company.

A shareholder agreement does not oblige the company itself. At the same time it is vital for a company to become a party to such an agreement for further acknowledgment.

This template can be accommodated for a shareholder agreement for s corporation, c corporation and a limited liability company.

What should a shareholder agreement include?

A shareholder agreement template is a complex corporate legal document that deals with shareholders’ relations and interaction. In some instances a shareholder agreement may resemble a prenup contract, as both documents are aimed at establishing clear rules and terms for building a business together.

While all companies are different in terms of their corporate structure, goals, and markets they operate in, most shareholder agreements are similar. Below, we prepared a detailed list of the most essential clauses a solid shareholder agreement template shall have.

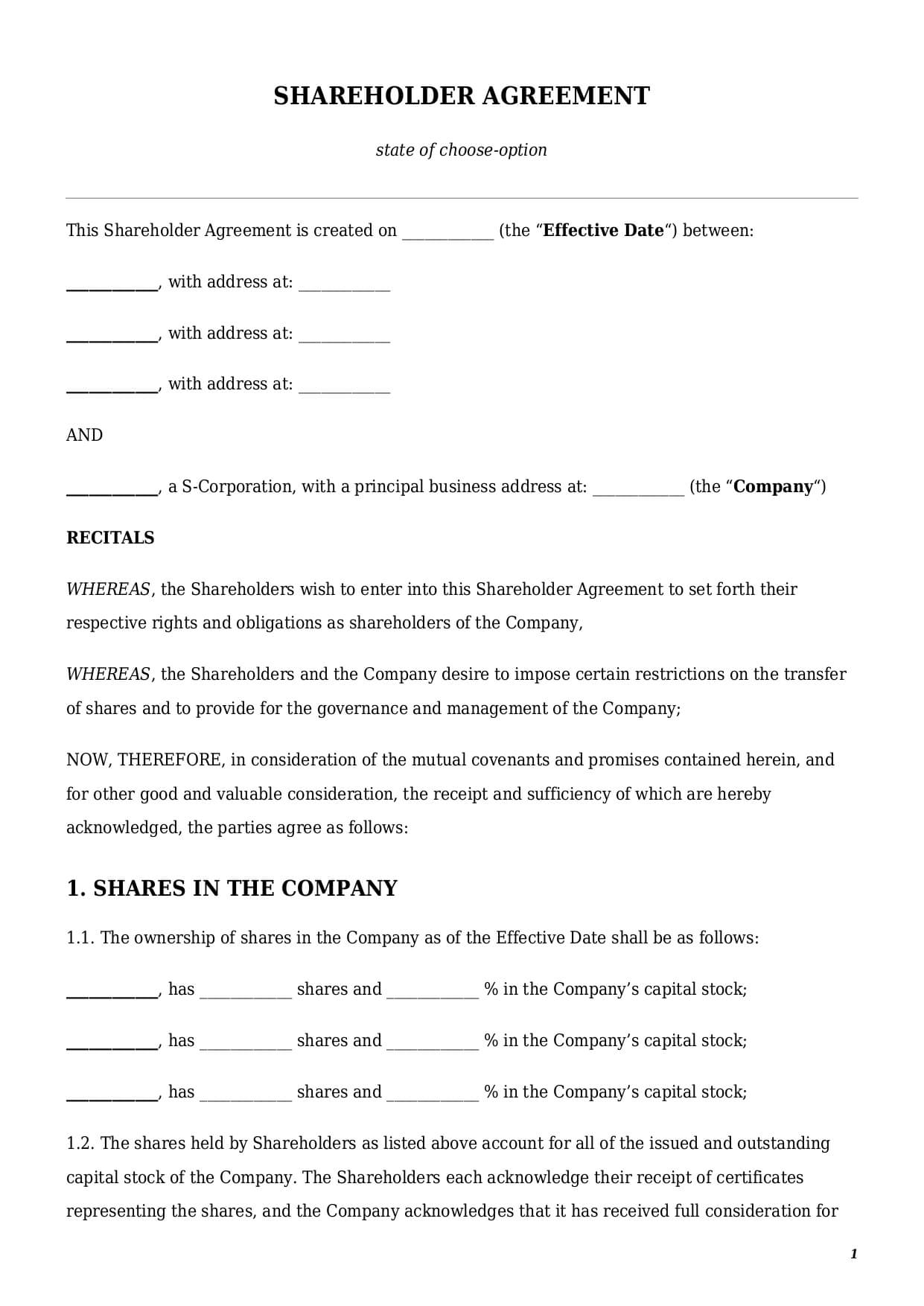

Details of the Parties

The text of a shareholder agreement template shall include:

- full names and addresses of all shareholders who sign it;

- shareholders’ signatures at the end of the document;

- full name, address, and type of company involved;

- date of signing a shareholder agreement; and

- the name of a state the laws of which shall apply towards a shareholder agreement.

Usually all the information given above, except for signatures, is listed in the preamble of the agreement.

Non-compete obligation

The clause number one most shareholders agreement templates have is a non-compete obligation for shareholders. It means that for the whole period of being a company’s shareholder and for some period after that, a shareholder shall not compete with the company. The wording “non-compete” means that the shareholder shall avoid being involved directly or indirectly in any type of activities that are similar to the business activities of the company.

For a solid shareholder agreement format, shareholders have to clarify certain details, including:

Duration: The non-compete obligation cannot last indefinitely. Therefore, the parties have to decide the period of time after a shareholder ceases to hold the company’s shares within which a shareholder cannot compete. An average period of time may last from one to three years.

List of competitors: It is always better to specify the list of a company’s competitors’ shareholders to avoid working for or doing business together.

List of non-competitive actions: in some cases certain activities may appear as “competitive” de jure; however, de facto they may not be competitive in nature. For instance, if a shareholder holds 5% of shares in a competitive company, such a shareholder cannot be considered as owning or operating a competitive business since 5% is a minor share. Therefore, the parties have to carefully consider together the list of exceptions.

Appointment of Officers

Officers deal with a company’s daily management and operations. By appointing a particular officer whom the shareholder trusts, such a shareholder may indirectly rule the company’s daily activity. Therefore, the inclusion of provisions related to the appointment of a company’s officers into shareholders agreement samples is of the utmost importance.

There are a number of things shareholders should discuss:

- Appointment process: Shareholders shall define how exactly the vote shall take place (e.g., all shareholders elect several directors, or each shareholder shall be a director, etc.).

- Duration of appointment: Shareholders may also limit the term of the board of directors, as well as include the list of specific events for immediate termination.

- Roles and responsibilities: In rare cases shareholders may also wish to include the list of directors’ duties and responsibilities directly in a shareholder agreement.

Corporate Limits

Even though shareholders cannot participate in a company’s daily life, they may want to be aware of significant financial decisions being taken. Those significant financial decisions may include taking loans, incurring debts, and entering certain transactions or agreements.

For situations like that, a shareholder agreement format may provide inclusion of corporate limits. This is when the board of directors has to seek prior written approval from shareholders to be able to make certain decisions about transactions. For instance:

- Taking a loan for an amount above a certain threshold requires an approval from shareholders;

- Entering a contract where the company’s annual financial expenses or obligations exceed a certain threshold requires an approval from shareholders, etc.

- Corporate limits may have various forms. Thus, the limitations given above are examples only. The main purpose behind such a clause is to allow shareholders to control the board of directors’ risk appetite.

Transfer of Shares and Limitations

Whether you create a shareholder agreement for small business or a big corporation, inclusion of additional rules related to the transfer of shares is essential.

When a shareholder wishes to transfer their shares, it means that they plan to sell or otherwise dispose of shares to third parties. Therefore, most shareholder agreements may impose additional limitations regarding how, when, and to whom such transfers could be made.

Reasons for the establishment of such limitations may vary from not allowing strangers to become a part of a company, especially when it is a family business, to avoiding manipulations with shares.

Right of first refusal

Inclusion of this limitation obliges a shareholder to offer their shares first to the company or to other shareholders. Only if a company or other shareholders refuse to purchase them is a shareholder free to dispose of them to other third parties. A solid sample shareholder agreement should contain the following:

period of time within which shareholders or the company may consider an offer (e.g., 30 days or 60 days from the date of the initial offer);

list of exceptions, when the right of first refusal shall not apply (e.g., donation of shares); and

terms and conditions of a shareholder’s offer shall be the same for both other shareholders and third parties.

Cool-off Period

Inclusion of a cool-off period is particularly common for a shareholder agreement for new company. During a cool-off period, also known as a lock-up period, the shareholders cannot transfer, sell, or otherwise dispose of their shares. Sometimes inclusion of such a clause prevents rash or emotionally driven decisions by some shareholders. In other cases it is aimed to “lock” the capital within the company for a certain period of time.

There are a number of important considerations related to the cool-off period:

- Duration: the lock-up period shall be limited in time and may last from several months to several years. In some cases, the lock-up period may start from the date of signing the original shareholder agreement. While in other cases it may automatically apply to any person acquiring shares in the company.

- Internal transfer: in some cases shareholders may exclude application of the cool-off period for internal transfers of shares between shareholders or to designated third parties.

Mandatory Buyback

A mandatory buyback is the list of events or circumstances upon occurrence of which a shareholder is obliged to sell their shares to the company. This clause might have a particular importance when drafting a shareholder agreement for corporation with a big number of employees.

To include a mandatory buyback clause in their shareholder agreement, the following tips should be taken into account:

- The list of circumstances triggering mandatory buyback shall be closed;

- The list of circumstances shall be clear and precise (e.g., termination of employment relations, death, bankruptcy, fraud, etc.);

- The clause shall also address how shares shall be evaluated before the sale.

Tag-along rights

A tag-along clause is known to be a golden standard for many sample shareholder agreements. It means that a minority shareholder is obliged to sell their shares when the majority shareholder is selling them. This clause has a particular practical relevance for companies with clearly defined majority and minority shareholders.

Usually, a sale of shares by a minority shareholder takes place under the same conditions as the sale of shares of a majority shareholder. Application of such a clause in practice might be tricky for a number of reasons. For instance, a majority shareholder may wish to sell their shares to affiliated parties for the price below the market threshold. To avoid this and other pitfalls and protect the rights of minority shareholders, a shareholders agreement template shall include the following limitations:

- list of third parties a transfer of shares to whom shall not trigger application of a tag-along right (e.g., affiliated third parties, shareholder’s immediate family members);

- notice period within which a majority shareholder shall inform about the terms and conditions of the offer; and

- detailed rules regarding the establishment of the sale price for the shares of the minority shareholder.

Drag-along rights

A drag-along clause is the opposite corporate tool to the tag-along. Under a drag-along clause, a majority shareholder may join a minority shareholder in selling their shares to the third party. Selling majority shares under a drag-along clause is more of a right than a majority shareholder’s obligation.

Dispute Resolution

One of the key components of every shareholder agreement template is a dispute resolution clause. This clause includes mechanisms helping shareholders to navigate potential conflicts confidently and without escalating disputes to the court.

There are three available mechanisms for a dispute resolution in shareholder agreements:

- Mediation: Shareholders shall attempt to negotiate and mediate the dispute informally. This is usually the first obligatory step.

- Arbitration: A process of binding resolution that involves a third-party expert or arbitrator.

- Deadlock Resolution: A mandatory process shareholders have to follow to end the dispute.

The parties are free to include all three mechanisms to deal with a dispute or to pick up only one of them. One tip we always recommend for creating a solid template is to decide on cost allocation rules for dispute resolution in advance. Such an allocation could be done in various ways, including:

- All costs shall be paid by a party that loses the dispute;

- All costs shall be split in equal parts (the most common); and

- All costs shall be split pro rata to each shareholder’s share in a company’s capital.

How to customize a shareholder agreement at Faster Draft?

To get your fully personalized legal document template, follow a few easy steps below:

- Click the button “Create Document.”

- Answer simple questions in the form.

- Select a document’s format—shareholder agreement PDF or Word.

- Make a payment.

- Download, print, and sign a customized document template in minutes.

Table of content

Frequently Asked Questions (FAQ)

-

1. How should shareholder agreements be signed?

Shareholder agreements should be signed by each shareholder who is willing to become a party to the agreement.

If new shareholders are joining the company with time, they shall also put their signatures.

When a shareholder is an individual, they should put their signature at the end of the document. If a shareholder is a legal entity, its official representative, like a director or attorney, shall sign a shareholder agreement on their behalf.

Neither federal nor state laws require the company to sign a shareholder agreement.

-

2. Shall shareholders' agreements be registered with the secretary of state?

No, state laws do not require shareholders to submit shareholders agreements for further registration. This is because a shareholder agreement is a private contractual arrangement between the company’s shareholders regarding the internal management of the company, distribution of profits and losses, as well as dissolution and dispute resolution.

Apart from that, the shareholders may not even inform the company about the existence of a shareholder agreement.

-

3. Is it mandatory to have a shareholder agreement?

No, signing a shareholder agreement is a choice and not a duty. Neither federal nor state laws require shareholders to enter any sort of additional agreement dealing with a company’s management, transfer of shares, etc.

Unlike a shareholder agreement, articles of organization or articles of incorporation are mandatory in nature. It is not possible to register an LLC or corporation within the United States without having either of those two documents.

-

4. What is the difference between a shareholder agreement and a company's bylaws?

Corporate bylaws are an internal company document that establishes the day-to-day operating rules for a company. You do not need either to register this document or to file it with a secretary of state.

Contrary to that, a shareholder agreement is focused more on shareholders’ rights and obligations within the same company. It helps to deal with a share transfer, withdrawal from a company, non-compete and confidentiality obligations, etc.

All in all, both documents are not mandatory in nature. At the same time they play an important role in a company’s corporate life.

Looking for something Different?

Start typing to find out our collection of legal documents and contract templates